Some of the problems in the high tech industry are enviable problems to have. To wit: having a lot of company stock because your company made it big.

[June 5, 2018: Note from Meg: This post has not been updated to reflect the tax changes signed into law at the end of 2017.]

Recently I’ve had the pleasure of talking with two women in tech who have this, shall we say, challenge. Both of them realize they need to make a change but aren’t sure what to do.

The two major headwinds to actually making that change are the tax hit and not knowing how to best use the sales proceeds.

Why is this a problem?

Although both of the women I spoke with recognize this as a problem, let’s just make sure we’re all on the same page here.

This “problem” sounds great, right? More money is more better, right? The problem is the unnecessary risk that this concentrated stock position creates.

UNnecessary Risk. We need some risk in order to have a chance for significant growth, which is why we invest in stocks in the first place. That risk is unavoidable.

But when you invest in only one company, you also assume the unnecessary risk that a single company’s stock will be affected by some event (a strike, a product flop, etc.). You can easily avoid this risk by “diversifying” your investments among many stocks.

Your tech stock is not magical. People in the tech industry tend to imbue their own company’s or their pet company’s stock with almost magical powers. I wrote about this in a previous post following a bad performance by Apple stock.

But remember this:

- Sometimes good ideas and good companies are not rationally treated in terms of stock price.

- Just because a stock treated you well in the past has almost literally nothing to do with how it will treat you going forward.

- You won’t know until after the fact.

There’s no use in keeping stock in order to avoid a 15%, 18.8%, 23.8%, or even higher tax on the gains if the stock loses 50% in the next year. And that happens. And not just to me.

So, we’re agreed that owning too much of a single stock is dangerous, right? If you don’t agree, I imagine you’re no longer reading, so…onwards!

I have to pay what?! in taxes?

The first road block to selling the stock is aversion to the taxes you will owe. But just accept it; you’re going to end up paying some taxes. (One could, if one were so inclined, mention something about public education, paved roads, and the FAA here…)

Before I get into the tax technicalities, may I make this one totally non-financial, I’m-not-a-psychologist-but-I-am-a-human suggestion?

As Johnny Mercer and the Pied Pipers would have wanted you to, you gotta Aaaccentuate the Positive, eeeliminate the Negative. Try to think of your gains in terms of the after-tax amount. This is 100% a mind game, and it can work. Instead of thinking

“I have to pay $38,000 in taxes! This sucks!”

try to think

“I am getting $152,000 of free money because I happened to work at the right company at the right time! Sure, I’ve got some paperwork to wend through that features numbers like $190,000 and $38,000, but in the end, I’m $152,000 richer! Go me!”

How Your Stock Gains Are Taxed

[Note: The tax brackets below apply to Married Filing Jointly households, for simplicity. Check here for more details about 2016 tax brackets.]

Capital Gains Tax. When you sell stock at a gain, you have “capital gains” income. If you sell the stock within a year of acquiring it, you pay short-term capital gains taxes on the gain; this tax rate is equal to your marginal income tax rate.

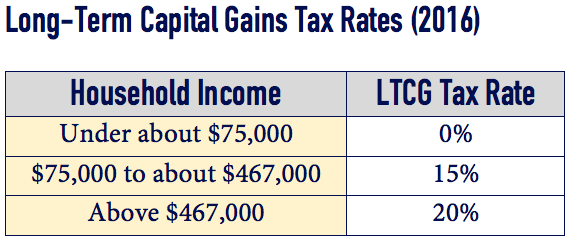

If you sell after a year, you pay the lower long-term rate, which depends on your household income.

Net Investment Income Tax. If your household income is over $250,000, you pay an extra 3.8% on top of the long-term capital gains tax rate (so, either 18.8% or 23.8%) for all capital gains above that dollar threshold.

Project other sources of income so you can sell stock strategically.

The strategy is to sell your stock in years when your other income is low. This way, your total income doesn’t trigger higher tax rates. I’m not talking only about income tax brackets, but also different capital gains tax rates, additional taxes, and the loss of personal and itemized deductions, which effectively raises your tax rate (as the excellent tax and personal finance blog The Oblivious Investor explains).

Simplistic example to illustrate this strategy.

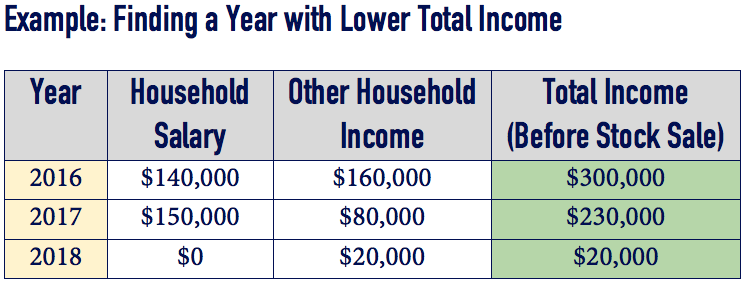

Let’s look at a married couple in the tech industry and their total income picture over the next, say, 3 years. They will have a salary, some investment income (dividends, interest, etc.) from taxable accounts, maybe some bonuses, stock options they choose to exercise, and vesting restricted stock units.

2016: Their total income is already above the $250,000 income threshold and will therefore pay the extra 3.8% tax (on top of 15%) on any long-term capital gains from the sale of the concentrated stock position. Not the best time to sell appreciated stock.

But they’re not yet in the highest capital gains tax bracket, so it’s not the worst time either.

2017: Their total income is “only” $230,000, so they could generate another $20,000 in capital gains and pay only the base 15% tax rate.

2018: For giggles, let’s imagine that our lucky couple has decided to take a sabbatical from both their jobs and travel the world in 2018, earning nothing but still having a bit of other income. This plan is not only a potentially excellent use for the stock sale proceeds, it also provides an excellent opportunity for selling a bunch of the stock, because their capital gains taxes could be as low as $0!

Sell the stock shares with the highest cost basis

If you sell two shares at the same time, they both sell at the same price. But if you bought them at different prices, you’ll owe a different amount of tax on each. The higher the cost basis (the price you paid for it), the small the capital gain and the lower the tax due. So, to jump start your efforts to reduce your stock holding, sell shares with the highest cost basis (and therefore lowest gains and lowest tax hit) first.

There are so many variables (tax brackets, extra taxes, lost tax deductions, etc.) that consulting a tax accountant or running scenarios through tax software is necessary to get a thorough understanding of how the strategies will affect your taxes.

The point is that there are good times to sell stock, from a tax perspective, and not-so-good times. What does your income look like over the next few years? What sale schedule could minimize your taxes?

Now seems like a good time to remind you that all of this tax planning needs to be coordinated with your portfolio. Sometimes it’s worth selling and taking a significant tax hit in order to avoid an overly risky portfolio.

If I gird my loins and sell the stock, what do I do with all the cash?

What else could you do with the money if it weren’t tied up in company stock?

Let’s start with the boring stuff: some of the sales proceeds should likely go straight to an estimated tax payment on the capital gains.Even if you’re salaried and income taxes are automatically deducted from each paycheck, this likely won’t cover the taxes owed on the capital gains.

What are your longer-term goals? (Earlier) retirement? Sending your child to college in 10 years? The money needs to remain invested for longer-term goals. But this time, put the money in a portfolio that is tailored specifically to those goals: a highly diversified, inexpensive portfolio with the appropriate risk level.

What are your short-term goals? Building up an emergency fund? Buying a house? Sending your child to college in 2 years? Paying off your mortgage? For short-term goals, keep the sales proceeds in cash.

Do you have debt, especially “bad” debt? If you have consumer debt, like credit cards and personal loans, using stock sale proceeds can be an instant win. If you incur 15% taxes in order to eliminate an ongoing, say, 15% interest payment, that’s a pretty darn good deal.

But even if the debt interest rate were lower, retiring that debt might still be a good idea depending on your attitudes towards debt and the loan terms.

Feeling charitable?

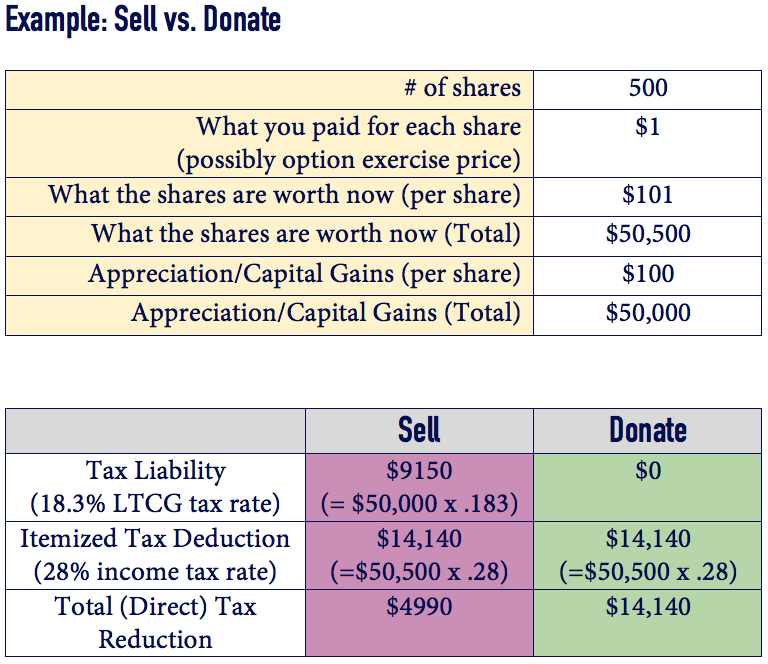

It is a shame how few people know about the awesome-tastic tax benefits of donating appreciated stock, that is, stock that has grown in value from the price you paid for it. But now you need count yourself among the ignorant no longer!

Here’s an example to illustrate the awesomeness of this strategy:

You are at least $9150 better off by donating those 500 shares than selling them and donating cash instead.

And if you sell, you also raise your Adjusted Gross Income (by $50,000 in this case), potentially rising into a higher tax bracket, incurring additional taxes, and losing personal and itemized deductions. Donating is just better-er.

This technique in and of itself doesn’t save you money because you’re giving away your money in some form. But if you’re going to donate money anyways, this is a pretty awesome way to do it. (How many times can I say how awesome it is?)

The client service team where your stock is held should be able to help you make a donation.

Give your kids a money lesson

Give some shares of the stock to your child (or godchild or niece or nephew or favorite neighbor kid). This strategy won’t meaningfully decrease the number of shares you own, but it’s a fun way to make the situation a “teachable moment.”

As much as my investment philosophy supports mutual funds over individual stocks, I think that as a teaching tool, stock in a single company is so much more tangible and effective.

Your child can track the performance of this one company, see how company performance relates to stock performance (hint: not predictably), learn rudimentary financial concepts, and generally get interested in finance and investing.

The client service team where your stock is held should be able to help you make a gift.

Write out a plan

Once you’ve thought through all these factors, write out a plan. The plan should list how much of the stock you’re going to sell each year (either $ amount or # of shares) and what you’re going to do with the sales proceeds (reinvest and how, keep as cash, spend on what).

It doesn’t have to be elaborate, maybe just a few lines in a spreadsheet. But If you’ve done your homework up front, then you don’t need to constantly wonder if you’re doing the right thing with the stock holding.

Is your portfolio dominated by a single stock? Do you want to make that money work for you in a more tailored, intentional way? And do you want to do so while minimizing the tax hit? Reach out to me at or schedule a free 30-minute consultation.

Sign up for Flow’s Monthly Newsletter to effortlessly stay on top of my weekly blog posts and occasional extra goodies, and also receive my Guide to Optimizing Your Stock Compensation for free!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner and/or an accountant for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.