Hopefully you’ve figured out the basics of your 401(k). Maybe you’ve even figured out whether or not you should contribute to your Roth 401(k). But are you ready for The Next Level in 401(k)?

Should you contribute after-tax money to your 401(k)?

Not all 401(k) plans allow you to make after-tax contributions to your 401(k). Google allows this, for example. Uber does not. So, you need to know whether your 401(k) allows such contributions. You could ask your HR department or look in your 401(k) Plan Summary. Look for the phrase “after-tax contributions.” (Tricky, I know.) Go on. I’ll wait.

But after-tax contributions to your 401(k) can help you “supercharge” your retirement savings, in a pretty darn tax-savvy way.

How After-Tax 401(k) Contributions Work

Step 1. Put Money into Your 401(k).

You can get money into your 401(k) in three ways:

- The “normal” contribution from your paycheck

Pre-tax money to your regular 401(k), or after-tax to your Roth 401(k) (or both!). In 2018, the “basic limit” (IRS term) for these contributions is $18,500.

(And yes, you saw right: it’s $18,500 in 2018, up from $18,000 in 2017. So, if your paycheck deferral is still set to automatically defer only $18,000, please change it now!)

If you’re 50 years old or older, you can contribute another $6000, for a total of $24,500. - Company match

If you’re lucky, your company will also match some of your contributions. Some matches are generous, some are not. Nothing you can do about it. - These “after-tax contributions” that we’re talking about today.

Even though both these and Roth 401(k) contributions are made with after-tax money, they are not the same thing. They are treated differently.

Added together, these three numbers cannot exceed $55,000 in 2018 ($61,000, if you’re 50 or older).

To belabor the arithmetic, if:

- You max out your “normal” contributions of $18,500 ($24,500, if you’re 50 or older)

- Your company makes a match of $5500

- Then you are allowed to contribute another $31,000 ($55,000-$18,500-$6,000) of after-tax money into your 401(k).

So, now you could have many “categories” of money in your 401(k):

- Pre-tax contributions + earnings

- Roth contributions + earnings

- After-tax contributions + earnings

- Company match contributions + earnings

Step 2. Move Your After-Tax Contributions into a Roth account of some sort. Any sort.

This move-to-Roth is where the real benefits begin.

[Section about automatic Roth conversions edited, 3/4/2021] Most of the big, “name brand” tech companies allow you to do this in an amazingly awesome way that I’m frankly surprised the IRS hasn’t gotten shirty about.

You can set it up so that as soon as that after-tax money is contributed, it is instantly/automatically converted to your Roth 401(k) sub-account. Why is this awesome? Because this means that not only the contributions but also all subsequent earnings on the contributions will be tax-free, because they’re all in the Roth account.

In practice, you should:

-

- Set up after-tax contributions on the 401(k) website. Usually you can do this right where you’re designating the % to go to pre-tax and the % to go to Roth.

- Call your 401(k) provider on the phone (yep, this is still usually what’s necessary) and say, “Hey there. I have started making after-tax contributions to my 401(k). I would like those after-tax contributions to be converted to my Roth sub-account. Could you please set that up for me.”

That should be it. All future after-tax contributions should be shoved into the Roth account without further effort on your part. Of course, I’d check after a paycheck or two to make sure.

If your company’s 401(k) doesn’t allow this intra-401(k), automatic conversion, the other way is to roll your 401(k) into an IRA when you leave the company, your company terminates or replaces your 401(k) plan, or if your 401(k) allows “in-service withdrawals.”

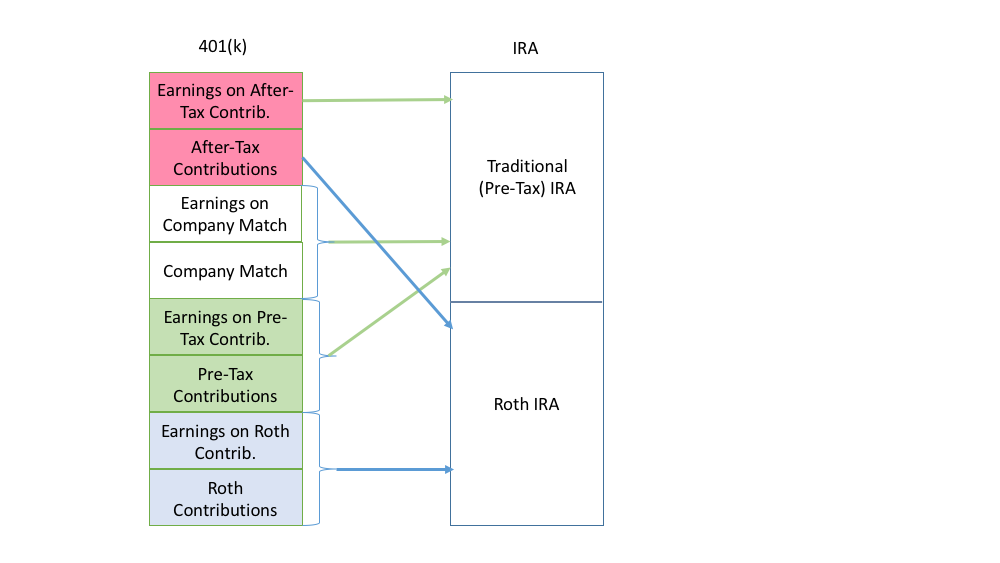

Pay attention to how each of these kinds of money gets treated in the IRA rollover:

- Pre-tax contributions and its earnings, Company match and its earnings, and earnings on your after-tax contributions will go into a pre-tax IRA

- Roth contributions and earnings and the after-tax contributions themselves (not the earnings) will go into a Roth IRA.

This strategy is referred to as a “mega backdoor Roth” contribution. So, now you’re all down with the lingo. Look at you…

The upshot: You can effectively put an extra, say $31,000, into a Roth IRA every year. For those of you earning more than $199,000 (married) or $135,000 (single), in 2018, you are not eligible to contribute to a Roth IRA at all. And the contribution limit even if you were eligible is $5500/year. So, this is an amazing opportunity!

Benefits of After-Tax 401(k) Contributions

Why would you make such contributions?

- You can get more much more money into tax-protected accounts than you’d be able to with the usual IRA contributions (witness the $5500 IRA limit vs. $55,000 401(k) limit). The longer you have until retirement, the longer that money has to benefit from its tax-protected status.

- You can get more money into a Roth IRA (eventually, when you roll it over) than your income might otherwise allow you to. If you and your spouse make, say $200,000/year, you simply can’t contribute to a Roth IRA. But you can put after-tax money into a 401(k), and then eventually roll those after-tax contributions to a Roth IRA.

- Your money is much more protected now than it would be if it were invested in a taxable investment account. Money in your 401(k) is protected from creditors, lawsuits, etc.

You Should Probably Make After-Tax 401(k) Contributions If…

So that sounds pretty awesome, right? Of course, you might be thinking, “Uh, yeah, if I had an extra $31,000 to save, that’d be a great idea. IF.”

So, the first requirement for making after-tax contributions is that you have the extra money to save.

I’d also like to see the following things be true for you:

- You’ve maxed out all other (appropriate) tax-protected ways of saving for retirement.

“Normal” 401(k) contributions are an obvious way to do this. If you’re still eligible for direct IRA contributions (in particular, if you’re eligible to contribute directly to a Roth IRA), do that first. Additionally, Health Savings Accounts can be an incredibly tax-savvy to save for retirement, possibly even better than your 401(k) or IRA! - You already have enough taxable savings and investments.

All of this money we’re talking about will be in some sort of retirement account. And retirement accounts make it difficult for you to get at your money (for good reason). There are taxes and penalties if you withdraw money. But money you have in bank accounts and in taxable investment accounts, aka brokerage accounts, you can use anytime for anything, no restrictions. This is why I think investing outside your 401(k) is so important. - Your 401(k) is a reasonably good plan.

You don’t want to trap extra money in your 401(k) every year if it’s a crappy plan, unless you have the opportunity to get the money out of it and into an IRA quickly. Fortunately, I find that plans that offer all these extra whiz bang features like after-tax contributions also seem to be on the ball when it comes to providing a good 401(k). - You are keen on early-ifying your retirement/financial independence.

Maybe you have goals that are more important to you than retiring early. Like, say, buying a home, or taking time off with a child, or starting your own business. (And yes, you could justly accuse me of some transference there.) You’re going to be able to support those goals more easily with money invested in a taxable account than with money in a retirement wrapper. - You expect to be able to roll the money over to an IRA within the next few years.

The longer the money can sit in a Roth IRA, and have both the contributions and the earnings grow and remain tax-free, the better. (Because, remember, when you roll from the 401(k) to the IRA, only the after-tax contributions can go into the Roth.)So, the further away you are from retirement, the more this tax-free advantage will benefit you. And therefore the less you need to worry about getting the money out of your 401(k) into your IRA super quickly.Now, in the tech industry, you’ll likely be able to get your money into a Roth IRA quickly anyways, just based on how frequently you change jobs. Also 401(k) plans that allow after-tax contributions often also allow “in-service distributions,” that is, you can roll this after-tax money into a Roth IRA while you’re still working for the company.

As you can see, in my opinion, after-tax 401(k) contributions make sense in fairly narrow circumstances. But if you’re in that situation, it can be an almost magical way of supercharging your tax-savvy retirement savings.

Do you make good money, you’re good at saving, and you can almost taste that Financial Independence? Reach out to me at or schedule a free consultation.

Sign up for Flow’s Monthly Newsletter to stay on top of my blog posts (and the occasional video), and also receive my guide How to Start a New Job (and Impress Yourself and Everyone Else) for free!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.