I know many things about the upcoming expiration of the Uber lockup:

- I know a lot of you work or used to work at Uber. You have a bunch of Uber stock. And you are counting the days until November 6.

- I know a lot of you want help figuring out what you should do come November 6. What does all of this Uber stuff mean for you? For your taxes?

- I know there simply aren’t enough financial planners to help all of you. Why this sad mismatch? Because there are a lot of Uber folks out there, and a surprisingly small number of financial planners who provide integrated, holistic financial planning advice and have the Uber-specific chops to help you.

If you are lucky enough to hold Uber stock (I suppose “lucky” depends on whether you’re looking at the stock price since IPO or the fact that you probably got it for damn-near-free), and you are realizing, “Sh*t, November 6 is right around the corner. I best gets me some advice!” give me a holler and I’ll connect you with some fee-only financial planners who can help. I’m pretty booked myself, but I Know People.

And for everyone who can’t or won’t work with an awesome financial planner, I wrote this blog post to help you come up with a reasonable strategy for your Uber stock, and to hopefully reduce your anxiety around it all.

I can’t give you specific advice in a blog. But I can share with you the framework I use with my own Uber clients to create a reasonable strategy for them. (And because we’re dealing largely with The Future, which is to say, with The Unknown, “reasonable” is my target here. Not “the best” or “awesome.”) If you follow the framework, you will at least be better off for having thought through it all, as opposed to the usual strategy of “Aaaahhhhh!!! I will sell everything because it stresses me out!” or “Aaaaahhhh!!! I will sell nothing because it stresses me out!”

How to Create a Useful Strategy for Your Uber Stock

Useful strategies are personalized to your situation. They are also:

- Clear

- Simple, and

- Objective

I do not want you going into November 6 with emotional wiggle room. No room to say on November 6 “ehhhh, that seems like a low price, I’m gonna hold on to my shares.” Or on Dec 11 to say, “ooh! The stock price went up some! I should sell some now because I’m afraid it’ll drop again!”

“Clear, Simple, and Objective” is the same way you should approach all of your investing. It just happens that this time, we’re talking about a single stock, possibly a lot of it, and likely making up a big part of your total financial net worth.

Ask Yourself These Questions

Here are some questions I discuss with my clients when we’re crafting a strategy.

How much of the stock do you want to keep in perpetuity?

Some people have emotional attachment to company stock. Some want to keep at least a finger in the pie, as it were, in case the stock price goes sky high.

Ideally, I think this shouldn’t be more than 5% of your total investment portfolio (or, even more simply, no more than 5% of your total Uber shares, especially if you have a lot).

What percentage of your original shares do you want to keep? I encourage you to choose a percentage, not a dollar amount.

Do you want to donate any to charity? How much?

Do you already have a habit of charitable giving? Do you know some charities you’d like to give to? Is this a particularly good tax year for you to do it?

If you got a bunch of RSU income (that is, a bunch of your RSUs vested on IPO day), then this is likely a very good year, from a tax perspective, to donate to charity: your tax bracket will be higher than usual, so you’ll get a bigger tax reduction than you would in other years.

If you want to donate a lot, consider a Donor Advised Fund. That helps you get the tax benefits in one year while allowing you to make the “whom should I give this money to?” decision in future years.

That said, donating to charity doesn’t save you money. You always have less money after donating than if you’d kept the money. Which is not to say “Don’t donate!” But it is to say “Don’t just mindlessly donate to charity because of the tax benefits. Any significant charitable contribution needs to be part of a considered strategy.”

Most likely if you got shares through RSUs, these will be rotten to donate because, at least as of now, these shares are in fact “underwater” (they’re worth less than they were on IPO day). You want to donate stock that has “appreciated” a lot. If you exercised options a while ago, and your “cost basis” is way lower than even $34 (Uber’s closing price on August 19), those are likely the good shares to donate.

Of course, when it comes to tax considerations, consult with a tax professional.

How much money do you need from this IPO to make sure your life goals actually happen? And how much of this Uber money would be more a “nice to have”?

The more you need the money, the more you should consider Just. Selling. Now (that is, soon after November 6). The more flexible your life goals are, the less they rely on you getting a specific amount of money out of this IPO, then the more you can afford to “gamble” by keeping the shares.

Here are a few examples:

- At the extreme end of things: Let’s say you have enough value in Uber shares that you have achieved Financial Independence. You Have Won The Game. As financial theorist and author William Bernstein puts it, “When you’ve won the game, quit playing.” Consider selling all the stock, pay the taxes, and invest in a low-cost diversified portfolio.

- If you are banking on this Uber stock for a down payment in the next few months, well, then, you should probably sell at least enough ASAP to generate the down payment. Because the stock market, and especially individual stocks, can easily lose 50% of their value in the course of a few months.

I’m honestly having trouble coming up with scenarios where you should keep a lot of the stock for a long period of time. It’s just Against the Rules, as it were, about how risky it is to keep a lot of your money in a single stock.

Especially if you’ve held Uber shares for a few years, it’s quite possible that you’ve already experienced the great increase in Uber stock value. Uber grew tremendously before going public. By contrast, for example, is Amazon, which went public early in its financial life and therefore had the opportunity for 100x growth after IPO. Hanging on any longer to Uber stock has a good chance of not seeing much more upside in the stock. (This is not a prediction. Just a possibility that you should take seriously.)

I’m sure there are reasonable scenarios for keeping a large (for you) chunk of Uber stock. Let’s see:

- You have a tremendously robust tolerance for risk (though up markets always make people forget just how much they hate down markets).

- You are one of those people who will never stop working regardless of your financial situation and you’ve got an iron in five other fires so if Uber stock goes splat, it really won’t affect how you live your day to day life.

- Losing all the Uber value won’t actually endanger you.

I don’t know. It makes me very itchy to even contemplate. But hey, you know you better than I do. I am Financial Planner, Hear Me Conservative!

A Sample Strategy

Before November 6, you should create an objective, not-open-to-interpretation strategy. It does not have to be much before November 6. You can’t do anything until November 6. The only reason to come up with a strategy earlier rather than later is so you have time to chew on it and see if it really suits you. (With exceptions for any charitable-giving work you might want to prep ahead of time.)

Your strategy can be based on stock prices. Or dates. Or # of shares. Or change in stock price day to day. It should have numbers and clear-cut rules. Of course, this doesn’t guarantee that you won’t break the rules…but you’re at least going to have to admit to yourself that you’re breaking them.

For example: I have 100,000 shares of Uber. The share price is $40 on November 6.

- I still owe $40,000 taxes on my RSUs that vested on May 10, and I didn’t previously have the cash to pay those taxes. So, ASAP on November 6, I sell 1000 shares plus a few more to cover the taxes due on the sale, to generate that $40,000. So, let’s say 1200 shares total.

- I want to keep 10% of those shares indefinitely, because maybe just maybe Dara is right and Uber really will become a profitable company that dominates transportation industries of all stripes globally. So, I set aside 10,000 shares.

- I want to donate 10% of my shares to charity. So, I set aside another 10,000 shares to donate to charity by year’s end.

- If you want to do this, maybe start the paperwork by the end of November. Charitable donations can overwhelm custodians like Morgan Stanley in the last few weeks of the year.

- In my example, I don’t want to donate directly to charities (that’s a lot of money!). Instead I want to set up a Donor Advised Fund, so I start the paperwork for that before November 6 because I want to be able to make the donation soon after, on November 20. (No particular reason for this date, just choosing something specific.)

- I want to take my partner on the trip of a lifetime, which will cost $25,000. So, ASAP on November 6, I sell 625 shares plus a few more to cover the taxes due on the sale, to generate that $25k after-tax. So, let’s say 700 shares total.

- With my remaining 78,100 shares, I follow this schedule:

-

- On Nov. 8,

- If the stock price > $45, then sell 75% of shares.

- If stock price is between $35 and $44.99, then sell 50% of shares.

- If the stock price is $25-$34.00, then sell 25% of shares.

- If the stock price is below $25, then sell 15% of shares.

- Then, 4 months later:

- Go through the same rules with your remaining shares.

- Rinse and repeat.

- On Nov. 8,

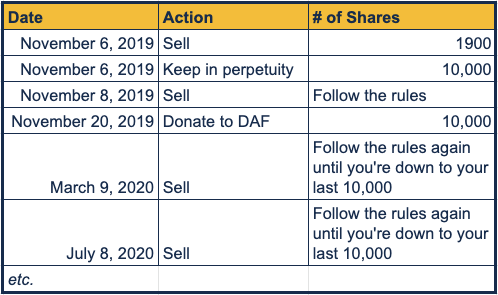

Here’s what my strategy looks like, in succinct table format:

My fictitious strategy probably makes No Sense for you. That’s cool. My point is that your strategy needs to be so cut and dried that a simple algorithm could implement it. It should not require your higher, human processing; that way lies emotions. Beware!

Next week-ish I’ll write a little bit more about the logistical considerations (blackout periods, insider trading, limit orders, TAXES, etc.). But for now, you can start thinking about those questions I pose above.

Is this blog Extremely Helpful and really oh-so-well written, but seriously, you still want to work with a financial planner? Reach out to me at or schedule a free consultation.

Sign up for Flow’s weekly-ish blog email to stay on top of my blog posts and videos, and also receive my guide How to Start a New Job (and Impress Yourself and Everyone Else).

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.