Some of our clients go through an IPO and come out the other end financially independent. Thirty-five years old, with $10M in the bank? Check. (Technically, not the bank, but a broadly diversified, low-cost portfolio. At least, that’s the hope!)

Others of our clients go through an IPO and come out the other end with a nice chunk of change, but it’s not “never have to work again” money.

And yet others of our clients never go through an IPO, but steadily squirrel away lots of dollars, year after year, from their high-paying tech jobs. For example, if you’ve worked for Apple for the last 10 years, you don’t need an IPO to have had the ability to build quite the nest egg just from saving a goodly portion of that RSU income.

Everyone kinda wants to be in that first category of “overnight financial independence.” But that is almost always outside of our control. I’ve started talking with more and more of our clients about the next-best thing to complete financial independence: “Coast FIRE” (Financial Independence Retire Early). (I cringe at all the FIRE jibber jabber in the personal-finance space, but this is simply the most succinct way to discuss the phenomenon, so forgive me!)

Coast FIRE is the state of finances where you don’t need to add to your retirement savings anymore, as long as you don’t withdraw from it. This means that, yes, you have to have a job that pays for your current lifestyle (and taxes, of course)…but that’s it. Which really opens up the world of job possibilities!

This relies heavily on the power of compounding.

The Power of Compounding

You ever hear the bit about how 99% of Warren Buffet’s (astronomical) wealth came after the age of 50? That is attributed mostly to simply Letting It Grow.

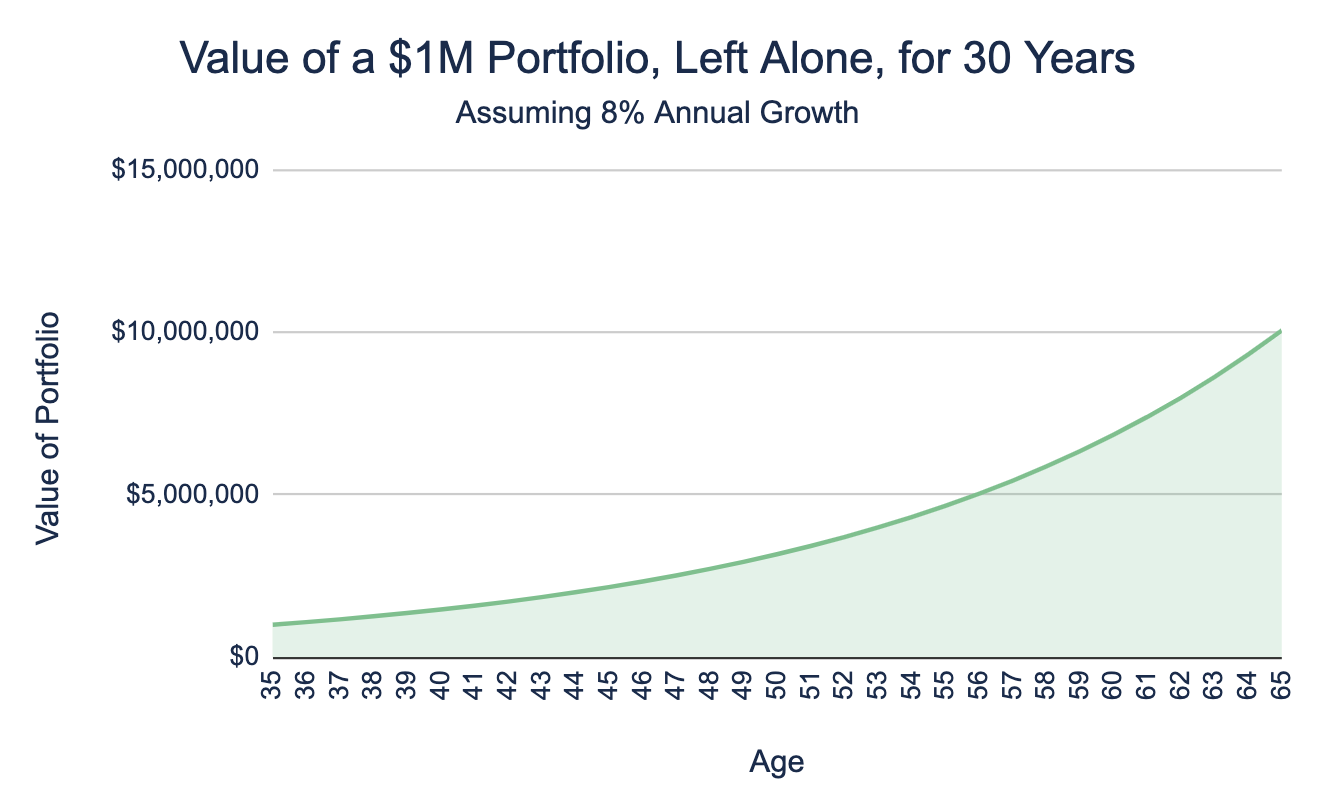

Let’s say your portfolio is worth $1M now. If you are in your 30s and 40s, you can’t quit working and live on that for the next five to six decades of retirement. (I mean, I suppose someone can, but the lifestyle sacrifices are ones that few people I know are willing to make.)

However, check out what happens if we invest that $1M and let it grow from the age of, say, 35 to 65 (30 years):

From the age of 35 to 56 (21 years), it grows from $1M to roughly $5M. And then in just the next 9 years (age 56 to 65), it grows from $5M to just over $10M.

Pretty nice when you haven’t put a single extra dollar into it, eh?

This is where putting your money in a low-cost, diversified portfolio, mostly in stocks, and then Not Getting Fancy comes in.

Keep in mind that our human brains don’t intuitively accept compounding. You really have to look at numbers and charts and hope your rational brain can override your lizard brain.

The Analysis We Do With Our Clients

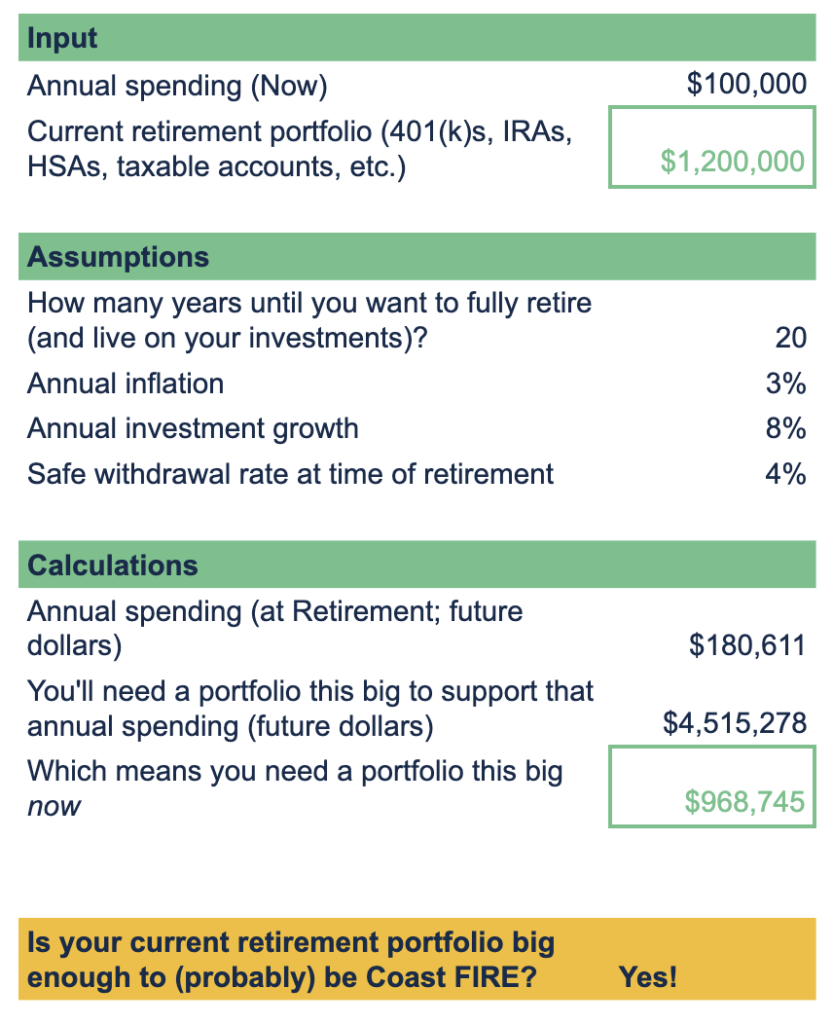

This is how we figure out whether our clients are in that enviable “I can stop saving” position:

We figure out how much you currently spend and the size of your retirement investment portfolio. Your retirement portfolio might consist of only your current 401(k), or it might be a complicated mess (a slew of 401(k)s, a traditional IRA, a Roth IRA, an HSA, and a taxable investment account…all of that x 2 if you’re a couple). Whatever.

We make some assumptions (aka, best guesses) about some essential pieces of information. To explain a little further about each of these numbers:

- How long from now do you want to fully retire and start living on your investments?

- Inflation has historically been an average of 3% per year.

- An 8% annual growth rate is a reasonable guess based on historical numbers, and of course it depends on what exactly you’re invested in.

- What will your safe withdrawal rate be in retirement? That is, what percentage of your portfolio can you safely withdraw each year and still be confident you won’t run out of money by the time you die?

Traditionally, this has been 4%, based on the original, seminal research in the early 1990s, by William Bengen. There have been a ton of follow-on studies and research that tweak this number based on how long your retirement will be or with how much you’re willing to reduce your withdrawals in years when your portfolio does poorly.

We calculate the size of the portfolio you need now to get to financial independence then (i.e.,at your retirement age), years down the road. This relies on present value and future value calculations, which are too hard by hand but a cinch by spreadsheet formula or financial calculator.

Is your actual current retirement portfolio bigger than what we just calculated you need?

If so, congratulations! You have a good chance of not needing to save any more money for retirement.

If not, welp…you need to save more. Or plan to work longer. Or lower your expenses. (There are only so many levers to reach financial independence, and these are the basic three.) You can probably use one of the umpteen online Coast FIRE calculators to see how close you are, how much longer, and how many more dollars you need to save to get there.

Note: There are a ton of Coast FIRE calculators on the internet. And they’re probably just fine (with a way better UI and UX than our spreadsheet). I mean, the logic and math aren’t that complicated (from a finance-nerd PoV). But because I don’t see how they’re programmed, I can’t reliably recommend them. The analysis we do with our clients is probably exactly the same; it just happens to be under our control.

You Can Stop Saving. Now What?

THIS IS THE WHOLE POINT.

What new opportunities or dreams or excitement can this open up for you?

If you only need to earn enough money to pay your taxes and your bills, and no more saving, maybe that means you can earn $20k, $40k, $60k, $100k less per year.

What kind of job would you be willing to pursue if your compensation needs were that much lower?

Now you can start thinking about your career, your work life, though a much more generous lens! That job that sounds meaningful to you? Or takes up less of your time, so you can work out more or volunteer or spend time with family? But it doesn’t pay as much? As long as it pays enough to simply cover your expenses, you can take it!

Make Sure You Don’t Boost Your Spending

If you’ve been making $300k/year, and you’ve reached Coast FIRE, great! You don’t have to save any more. Your current investments, if left to compound over many years, should be enough to cover your spending at the time you start living off of your investments.

So far, so good.

But let’s say you are accustomed to starting with $300k, paying some taxes, saving some of it, and then spending the rest. When we remove the saving from that equation, what’s left over to spend is way way bigger.

If you get accustomed to spending that way bigger amount, now you actually need way more money in the future to cover this now-much-more-expensive lifestyle.

So pay attention. Maybe you find that you can spend some more, but you’ll still continue saving, just less. And the continued saving (though less than before) should be enough to make up for the higher (though not all that much higher) spending.

Or maybe you leave that $300k/year job and take an $80k/year job at your favorite non-profit (as a client recently told me she had considered). Now even if you don’t save anything, the money you have available to spend is way way less, and this risk is moot (as long as you’re not touching your retirement portfolio).

Keep Room for Error, and Make Adjustments Along the Way

I don’t encourage you to cut this analysis close. At the age of 35 or 45…or 65, there are still way too many years ahead of you during which too many unpredictable things could happen that would render your calculations obsolete.

The declaration of your “Coast FIRE” status is predicated on you making pretty accurate assumptions about:

- how long you’ll leave the portfolio to grow before you retire. Even if you somehow knew when you wanted to retire (which, in my opinion, is unlikely more than a few years out), a lot of people end up retiring earlier than they’d planned, often due to health or disability. (The 2021 Retirement Confidence Survey (the 31st annual), by the Employee Benefit Research Institute (EBRI) and Greenwald Research, recorded that 47% of people fall into this category.)

- how much your portfolio grows each year

- how much you spend each year (which in turn depends, in part, on inflation)

Unfortunately, one thing I can almost guarantee you is that there is no way that you can reliably predict these numbers two to three decades out. So, be a bit conservative in your assumptions.

If you’re at Coast FIRE with a 9% investment growth rate, what happens if there’s only 7% growth? What happens if inflation is 4% instead of 3%? What happens if you’re forced to retire in 15 years instead of 20?

Regardless of your current Coast FIRE status, even if it has plenty of room for error, Life Still Happens. For the good or the ill. This is why you don’t run this analysis once when you’re 35 or 40 and then ignore it for the next 20 years. You want to check in every one or few years (depending on just how much life is happening).

Maybe you find you need to start saving again. Or cut back on your expenses. Maybe you find you’re even more solidly Coast FIRE and therefore can plan to fully retire earlier. Or start living now on a small amount of withdrawals from your investment portfolio to add to the income from your job.

I think it’s healthiest to have an attitude of “I’m probably Coast FIRE” as opposed to “I’m definitely Coast FIRE.” And then test that hypothesis regularly.

Implications for When You’re Younger/Earlier in Your Career

Financial advice has long been of the sort “Save as much as you can as young as you can. Pinch your pennies! Delay your gratification!”

It’s not exactly exciting or motivating advice for people earlier in their careers.

Then we have a new generation of financial folks, from licensed financial advisors to influencers like Ramit Sethi, who are all, “Whoa whoa whoa WAIT a minute. There’s a way to enjoy your life now and still be responsible about your future. Anyways, you never know how long you have on this planet, and it’d be a shame to never get to that future you’re scrimping and saving for!”

I very much appreciate this more humane—and probably ultimately effective—approach to personal finances.

That said, let me summon some good old fashioned “Ack, save early and often!” energy.

What we can see in this post is that the earlier you start investing money, and the more money you invest early, the sooner you can stop worrying about it. The sooner your job can stop focusing on “how much does it pay?” and start focusing on “what kind of life and meaning does it afford me?”

Now, there’s always a balance, right? You’ll want to fit this decision to who you already are. If you are frugal by nature, and find yourself pinching pennies in order to save and invest more, well, you’ll probably benefit from loosening the purse strings a bit and enjoying life more now. If you haven’t given a thought to saving for the future or only put enough into your 401(k) to get the match, well, then, you probably want to kick it up a notch, as the Wise Emeril once said.

Coast FIRE is only one path—of many—to more freedom in your life and choice in your career. But if you find yourself there, whoo! Now, I ask you:

How are you going to use this freedom to change your life so that it is more aligned with your values?

If you think Coast FIRE might be a path that fits your situation and you want to explore further, please reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.