You’re in your 30s or 40s (and heyyyy all of you inching over the line into your 50s). You have what sounds like a lot of money. But when you think about the fact that you might live for another 50 or 60 years? It starts to sound like maybe not that much money.

In a recent blog post, I discussed how to think about turning your investment portfolio into an actual stream of income to live on. I introduced the idea of the 4% withdrawal rate: you multiply 4% times your investment portfolio, and that’s how much you can withdraw from your portfolio each year. For example, 4% x $1M portfolio = you can take $40,000 out each year.

I also suggested that if you have a time horizon that’s way longer than 30 years (which is the traditional planning horizon for retirees), you likely want to reduce that 4% to 3%, maybe even 2.5%, to make it more likely that your portfolio will last the rest of your potentially very long and craaaaaazy life.

(There is more nuance to the 4% withdrawal rate, which I’d encourage you to learn if you wanted to actually do your own planning. For this post’s purposes, what I wrote above should be enough.)

Because of the length of life still awaiting these clients, and the inherent uncertainty of alllll that time, our clients understandably feel better when they are conservative with their portfolio withdrawals.

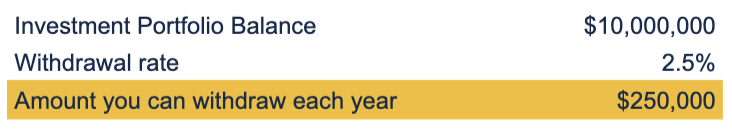

So, we deem a 2.5% withdrawal rate a good bet, and make the calculation. If you have a $10,000,000 investment portfolio (that’s a lot of money!), that means you can take out $250,000 per year (this feels way smaller than you’d think $10M could support).

Now that we know this $250,000 number, you have a choice:

- Withdraw more than 2.5%, to fully support a higher cost of living.

- Withdraw 2.5% and reduce your expenses to match that.

- Withdraw 2.5%, keep spending more than that…and make up the difference by earning some money with a jobbity job.

As for #1: In the vast majority of cases, in the original 4% study, people who withdrew 4% for 30 years ended up with more wealth at the end. The 4% is a worst-case-scenario strategy. So, if you withdraw, say, 4% or 5% (or more!) from your portfolio, it could last the rest of your life. But it’s far less likely to.

I’ve had some clients choose #1, with the (intellectual if not emotional) knowledge that this is an unsustainable rate and they’ll have to reduce it (maybe radically) in the future. Sometimes they’re simply going through big transitions in their lives and are theoretically okay with the idea of taking a lot of money from their portfolio to make that transition.

I’ve had some clients choose #2. Even though the percentage is low, the resulting dollars were enough for them to live happily on.

Earning Money on Top of Portfolio Withdrawals. How Much?

I want to linger on #3. Not that I don’t like #1 and #2, but #3 is, in my opinion, a really fun example of planning where a compromise makes everything so much easier. I’ve walked through this analysis with several clients recently, and they all found it clarifying and reassuring.

Especially given that my clients are so young, even if they’re currently not working, they are almost certainly going to work again, in some capacity. It’s therefore usually reasonable to assume they’re going to earn some money in the not-too-distant future.

One benefit of approach #3 is that it minimizes the amount of money you have to make from that job, thereby opening up career possibilities for you, to take jobs more for passion or meaning than for income, or to work part time.

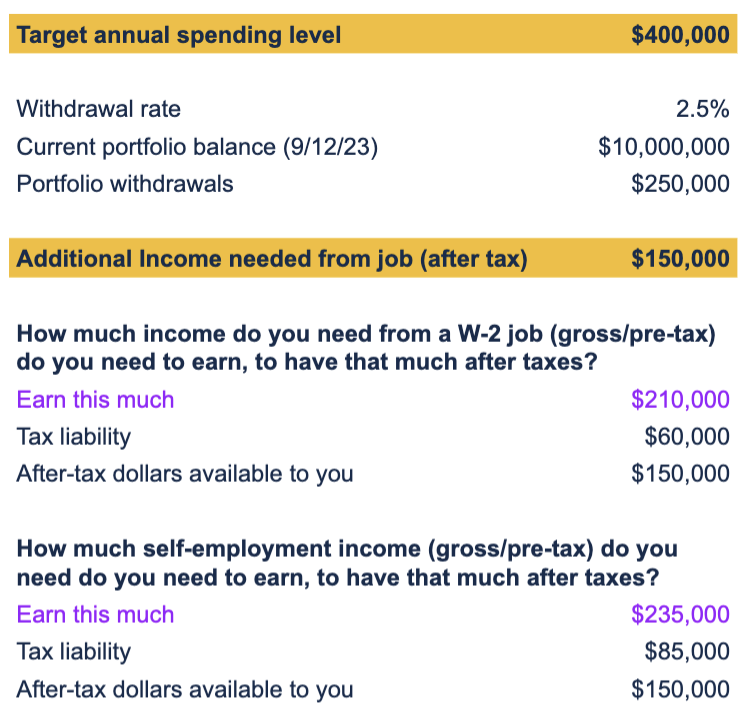

This is a great example, I think, of financial independence, even if you still actually need to earn some money. If you need to support a lifestyle that costs $400,000/year, well, that is definitely gonna narrow the career options for you. But if you need instead to earn enough to support $150,000 of spending, there are a lot more jobs that can provide that to you.

Below is a simplified version of the analysis we do for our clients exploring this path:

- We establish how much their desired lifestyle costs (“Target annual spending level”) ($400,000).

- We calculate how much they can probably sustainably withdraw from their portfolio ($250,000).

- We calculate how much they then need to earn from a job to make up the difference ($150,000).

- We then use software to figure out how much income you need to earn before taxes are taken out to provide that $150,000 after tax. This number is different depending on whether you’re an employee (W-2) or self-employed. (Tax rules differ between those two camps.)

How would you calculate this income number yourself? Our software, made for financial professionals, is pretty robust, and we can enter in all sorts of details about our clients’ tax situation. You could probably use something like this calculator, at least for a W-2 job, to figure out how much pre-tax income you need to arrive at a certain after-tax value. It might not be as detailed as the software I use, but it should get you to a useful ballpark. (There are probably other good DIY tools out there. I’m simply not familiar.)

After this analysis, my clients know specifically how much they need to earn from a job if they want to maintain their current lifestyle. It’s certainly not complicated math. (Now, any time tax calculations are involved, it’s definitely complicated. But, basically all financial professionals use software to calculate taxes because the tax code is simply too vast and too complicated to do back-of-the-napkin calculations.)

Until you have the <I can take this much out of my portfolio> number and the <my job must pay me this much> number, you might feel like some of my clients: you have a big pile of money, no idea how much of it you can safely withdraw/spend on what schedule, and accordingly, no idea what kind of life you can build for yourself and your family.

So, it’s kinda delicious that a calculation as straightforward as the one above (it’s mostly just arithmetic!) can be the “unlock,” as one client called it, to you feeling way more in control of your financial situation and future.

If you’re still young(ish), have significant wealth, and are wondering how you can use it to support your lifestyle, reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.