Though the fervor around “financial independence” has abated a bit in recent years, I still see quite a bit of it. (Perils of the job, doncha know.) In fact, I most often see this “I want to retire now!” from women who are burned. the f*ck. out. by their career in tech.

I hear myself saying over and over to clients and prospective clients (and the void): Don’t worry about becoming financially independent. Just become financially independent enough.

What does that mean? Why do I say that? What does it matter to you?

Financial Independence Is a Spectrum.

I don’t know how people think about it now, but Financial Independence used to be pretty categorically interpreted as FIRE (Financial Independence, Retire Early), as embodied by the extremely frugal likes of Mr. Money Mustache. I’ve previously written about FIRE, from a women-in-tech perspective.

Did you know there are all sorts of funny-sounding variations on the FIRE theme now?

There is, according to this blog (written by another one of the OG FIRE folks):

- Fat FIRE

- Lean FIRE

- Barista FIRE (ha! I hadn’t heard about this one. Evidently my husband unwittingly Barista FIREd, except that I actually like my job), and

- Coast FIRE

They all vary in terms of extremeness in saving and spending.

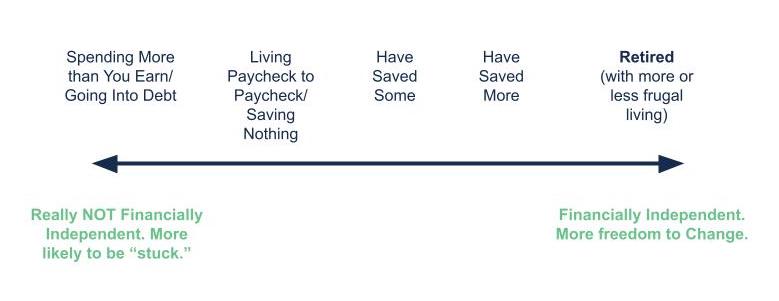

I personally don’t use the FIRE Movement’s terminology as listed above. I think about “financial independence,” sure. But I think about it along a spectrum of either more or less financially independent:

Aiming for Complete Financial Independence Can Easily Be Harmful.

I think aiming for complete Financial Independence at an early age can be harmful in several ways.

It could cause you to stay in a high-paying job you dislike just to save the money so you never have to endure this sh*t again.

Yet, why are you enduring it now? I have seen so many women in tech who are so burned out by their jobs that they can’t even fathom what could come next. They need a break just to let their spirit and imagination spark to life again. That is a minor tragedy.

If you calculate how much money you need, especially at a young age, to achieve complete financial independence, it’s likely going to be huge.

That can be so daunting that you give up even trying, which is the worst thing that can happen in your pursuit of financial independence. Better to go more slowly and persist than more quickly and burn out. (Methinks there’s a parable about this somewhere…)

Practically speaking, if you think about (1) the truly powerful effects of inflation over many years (compounding doesn’t work exclusively in your favor, it turns out!), and (2) the idea of needing a big enough pile of money to live off for decades, of course the number is going to be huge! The shorter you can make your retirement period, the easier it’s going to be to have enough money to be financially independent.

It creates the impression that the goal in life is to Not Work, instead of allowing you to think about doing meaningful work in your life.

The more fulfilled we each are by our work, the better off not only we individually will be, but so will our communities and families.

Eventually, yes, we likely all want to be fully financially independent. But imagine a life in which you can achieve that goal after years of not suffering through extreme frugality (or guilt at not being extremely frugal) and not suffering through work that drains your soul.

What a concept!

Be Financially Independent…Enough.

Obviously, at some point in your life, you’re going to want to be fully financially independent. This is what we have traditionally called “retirement.” I’ll give you that. At some point in your life, you likely will want to stop working completely.

But until then, I think it is not only sufficient but, in fact, desirable to aim for being financially independent enough.

Enough to quit your job without having another one lined up.

Enough to take a sabbatical.

Enough to be laid off…and not freak out.

Enough to leave a bad living situation.

Enough to decide to go back to school.

Enough to start a business.

Enough to help out a family member if they have a big medical event.

Enough to start a new career at the bottom rung.

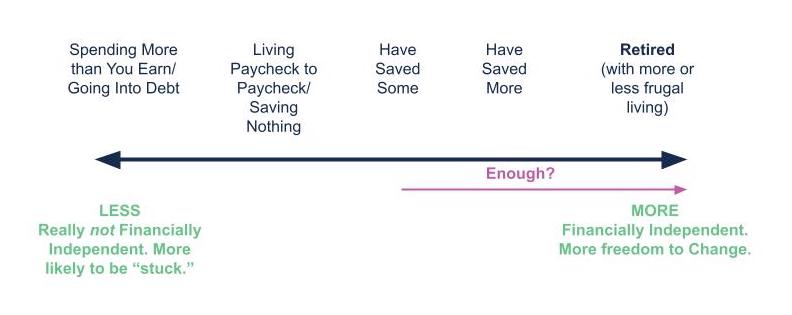

Remember when I was talking about financial independence being on a spectrum? Well, “enough” covers a large part of that spectrum, not just the “I can retire now” end point:

Enough, to me, means more than just an emergency fund. Now, an emergency fund (typically equal to 3, 6, or even 12 months of living expenses) is essential. But it might not be enough for the larger “pivots” in your life. It could be enough to help you quit a job but not enough to put you through graduate school.

The “enough,” of course, depends on how it is you want to change up your life.

The bigger the pile of money, the more opportunities it’s “enough” for.

And then once you’re settled in your new direction in life—with your new career or new job or new location or new business—you can start replenishing the “enough” and resume building your wealth towards, yes, that ultimate, total Financial Independence Retire Now.

If you are burned out, depleted, just done with your job or even your entire career in tech, I don’t think you should hang around, miserably, just so you can build up so much money that you never have to work again.

You do need to build up enough money to be financially independent enough. And then you can leave and take care of yourself. In fact, many of you probably already have that level of financial independence.

Life is too long and too (irreducibly) uncertain for you to require yourself to reach such a state of financial certainty. Just be certain enough.

Do you want to be confident that you have enough money to make the changes you want to make in your life? Reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.