Have you decided you want to do something about all this company stock, but you’re stymied by not knowing how? It’s a giant elephant, and you have no idea how to take the first bite.

Our elephant-eating process is, I believe, logical and simple and I will share it with you below. Before we start getting into the details, details that might be distracting, I want to emphasize the two most important points:

- Get clear on you. You will make the best decisions for you if you know who you is and what you value.

- Diversifying (getting out of the company stock) is, statistically speaking, going to give you a better “risk-adjusted return” than having a concentration in your company stock. This is just math.

They say personal finance is personal. This decision about what to do with company stock is a great example of it being, yes, personal but also not. Your motivation to do something with your stock and the details of your plan are highly personal. At the same time, the math of diversification is the same for everyone, regardless of your feelings and aspirations and values.

Get Clear (As Clear As Possible) About What’s Important to You

In general in personal finance, and probably life in general, the clearer, the more vivid, the more exciting the picture is of what you’re trying to create for yourself, the more obvious the answers become. Answers to questions like “How should I spend my time? Should I do/not do that? What should I spend/not spend my money on?”

This is so so hard to do, surrounded, as we are, all the time, by people who aren’t you, and especially surrounded by colleagues with the same company stock who probably have somewhat of a mob mentality about the stock.

Whether this involves therapy or meditation or journaling or work with the right kind of financial planner (hi!) or regular conversations with friends who can help you plumb these depths, you need to have an ongoing practice of getting in touch with You. Because outside influences are pervasive and will never stop.

Sell Enough to “Secure” that Important Stuff

When we’ve worked with clients to get clear on what’s of utmost importance to them, what they simply must have in their lives, we find answers like:

- Owning a home

- Putting my kid through college with no debt

- A remodel

- A sabbatical

- A car

- A big trip

- Going back to school

- A new, lower paying career

- Donating to my favorite charities

Our goal in this company stock strategy becomes first and foremost to secure those goals. We do that by selling enough company stock to fund those goals. See? Simple, right? I dare say logical, too.

A technical note: If charitable giving is on the list, then selling, per se, might not be the right thing to do. Instead of selling and then donating the resulting cash, it might be way better for you tax-wise to donate the shares directly.

The Rest Is More Flexible

My friend and colleague Aaron Agte taught me to look at company-stock concentrations this way:

Let’s ignore the company stock for a while. Can your savings rate out of your normal income get you to your goals (say, retirement) at a desirable age? For example, if you’re already saving from your salary to your 401(k) and maybe also a taxable investment account, can you build up investments fast enough that you can retire at age 60? Is that an acceptable age?

If so, that means that you can consider taking more risk with your company stock. If you hold on to it and it goes to the moon, great! Now you can retire even earlier! If you hold on to it and it goes <womp womp>, well, that sucks no doubt, but we’ve already established that the rest of your financial picture will be sufficient to allow you to retire at age 60.

Let me repeat: This is a risky choice. On average, you are going to get to you goals more reliably if you diversify. But I also know that we all have heard the endless stories about the person who simply held on to all their Apple or Amazon or Microsoft stock for two decades and now they’re sittin’ pretty. Aaron’s outlook allows you to take more risk, but without risking the essentials.

Concentrate to Build Wealth. Done! Now Diversify to Preserve Your Wealth.

I have found that clients easily decide to sell some company stock when there’s a specific life goal the money can fund, as discussed above. I have in fact oft talked about my favorite “alchemy” of turning company stock into a home.

What is not particularly persuasive is “So, statistically speaking, you will maximize your risk-adjusted return and are far more likely to grow your investment portfolio if you sell your company stock and invest the proceeds into a broadly diversified, low cost portfolio.”

And yet. And YET! That is, in fact, the truth. Modern Portfolio Theory (MPT) shows that, on average, your investments will have a higher “risk-adjusted return” if you hold a diversified set of investments, not a concentration in a single stock. Diversification is “the only free lunch” in investing.

I get it: It’s really hard to let go of the company stock, especially if it has grown in value. The natural thing to expect, when the stock price has recently gone up, is that it will continue to go up. (And boy, how 2021 and 2022 put paid to that belief for many people with tech stocks. At least, for a while.)

I invite you to think about it this way: If you have a giant pile of company stock worth a lot of money, you have already benefited from being concentrated in your company stock. Now is probably the time to protect and preserve that wealth. “Probably” because I can’t be giving any explicit investment advice in this blog because I don’t know you and I care about my compliance consultant’s blood pressure.

In my line of work, the rule of thumb is that no more than 5% of your investment portfolio should be in a risky or concentrated investment. And hell, 0% concentration is the holy grail: MPT suggests that we should own stocks and bonds in direct proportion to their size in the market (which suggests investing in “total market” funds that simply “own the market”). Own crypto? No more than 5%. Picking individual stocks at Robinhood? No more than 5%. Company stock? No more than 5%.

Our clients often end up with 70% or more of their investment portfolio in company stock. On rare occasion they are totally cool with simply selling down to 5% immediately. I then stare at them in goggle-eyed amazement. “Who are you? And how can you possible work in the tech industry with this level of detachment from company stock?”

But usually, they aren’t quite “there” yet, and I am content to reduce the concentration some. This approach serves two purposes:

- It lowers the risk in the portfolio (the risk created by having money in a single company) by however much we reduce the concentration.

- Sometimes it breaks a psychological “log jam” preventing you from selling any company stock. Once you sell some company stock, you now know how to do it, and you see that you don’t die when you do it. You’re therefore more likely to do it some more.

An Example from Our Work

I distinctly remember a conversation with a client that demonstrated so clearly the power of attaching this financial decision to life goals. The husband worked for a recently IPOed company, the stock had done very well, and he was optimistic about the company. The stock had increased their family wealth by a lot, and a lot of the wealth was still in the company stock. The wife was less “attached” to the company stock and was already of the mind (even without my masterful oratory powers) to sell more of it.

I get really worried when clients have a lot of their wealth in company stock. Sure, it might continue to increase in value, but it’s really risky and I don’t want to see their goals—and emotions!—get obliterated if that one company does poorly. But talking about probabilities and concentration risk did diddly squat to change this guy’s opinion about selling, or rather, not selling. So, I took a different tack with him:

Me: You’ve mentioned before that it’s really important to you to be able to pay for Daughter Kim’s college, so that she can leave college debt free. Do you still feel that way?

Him: Yes.

Me: Okay, so imagine her college savings account was full, that you knew you could pay for her entire college tuition, no matter where she goes, and she would graduate from college without debt. How would you feel?

Him: Dammit, Meg. I’d feel GREAT, okay? GREAT. Okay okay, I’ll sell some stock.

Wife: <smirking, in the corner of the screen>

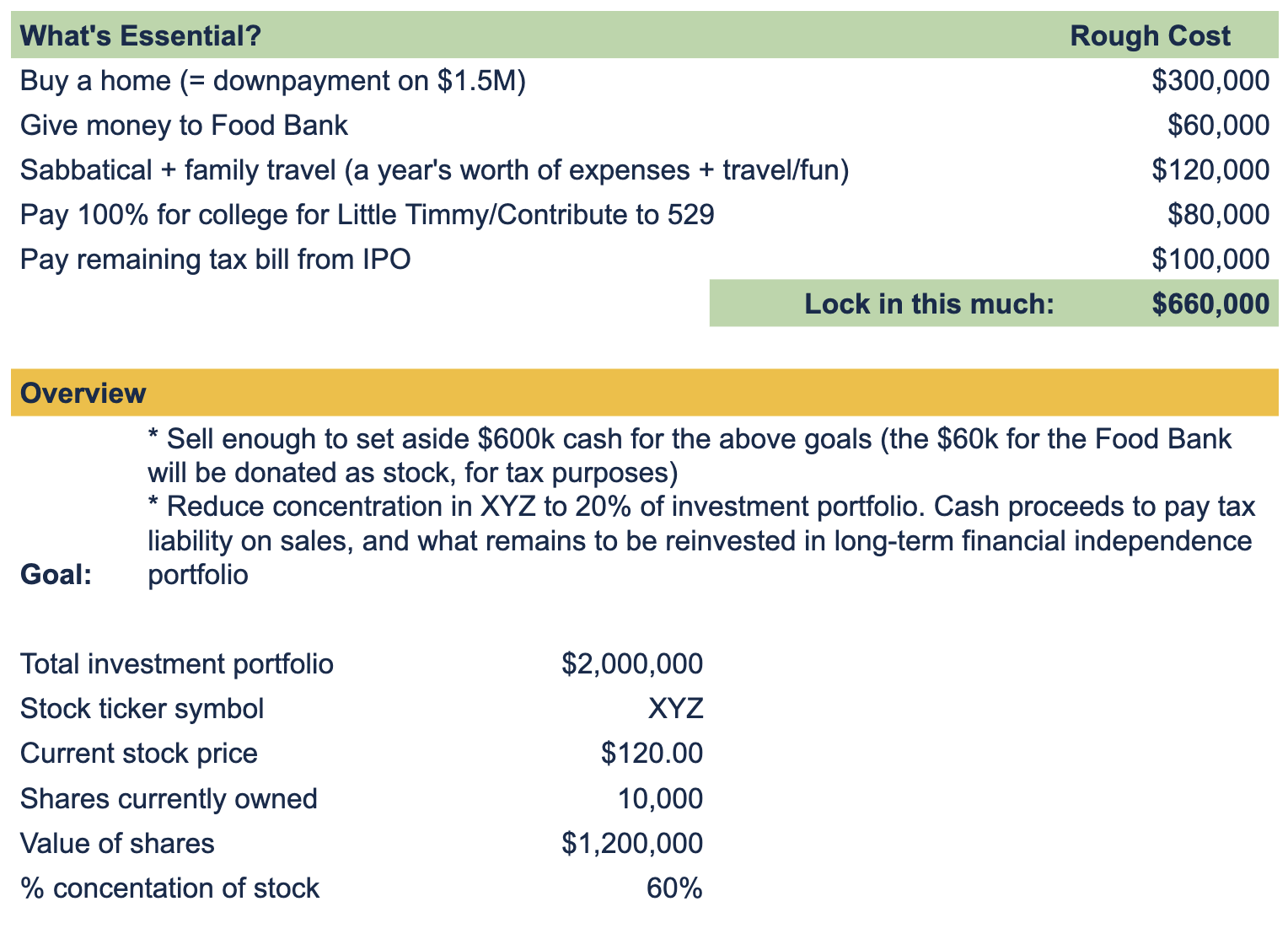

We use a pretty plain Jane spreadsheet to help organize such conversations with clients. I present it below. (Yes, BEHOLD MY AMAZING DESIGN SKILLS.)

Let me walk you through it. We:

- Start with identifying the things that are really important to you, and attach a price tag to them. I cannot overemphasize how important it is to do this work first, in almost all financial decisions, especially the big ones!

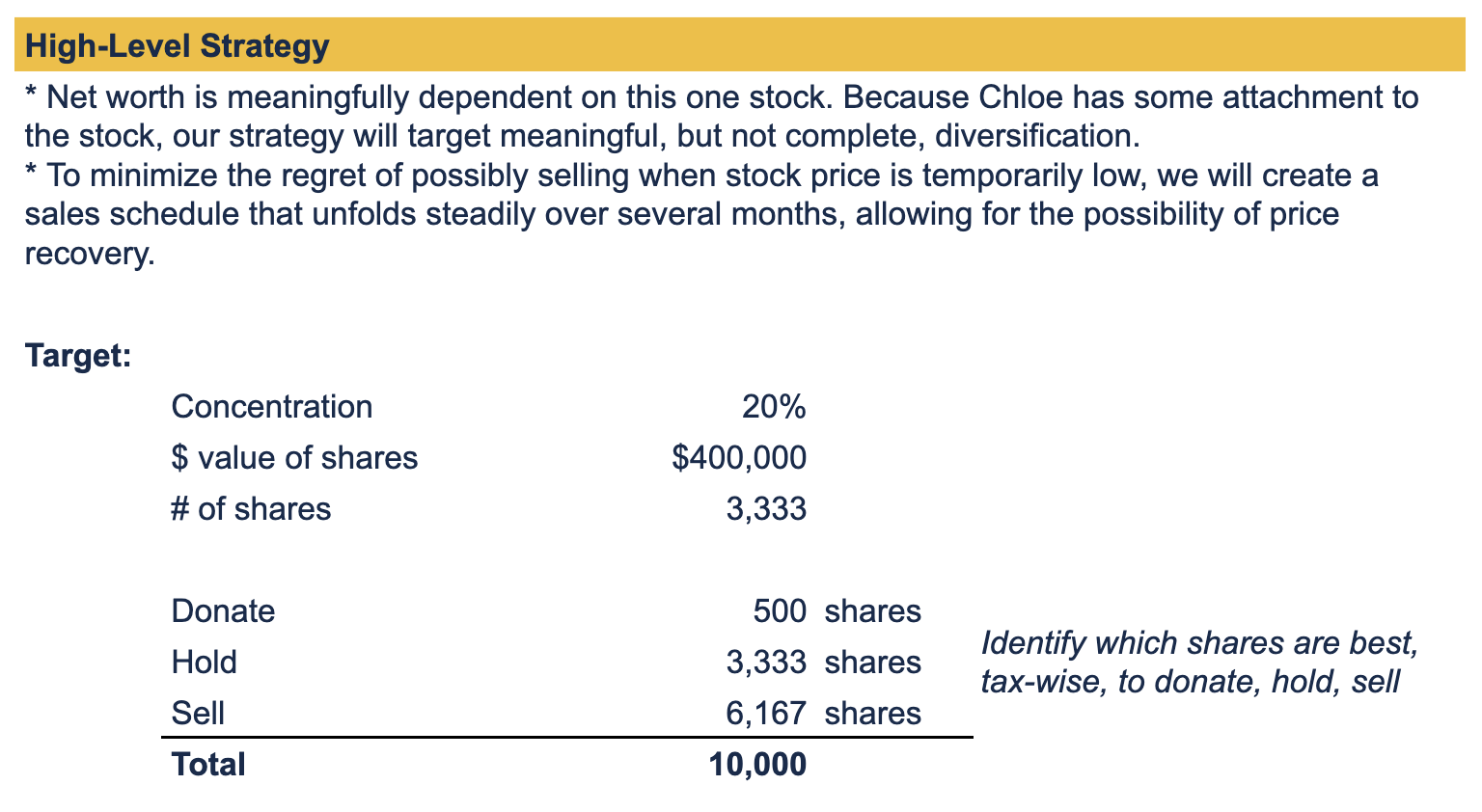

- Talk about the (emotionally much less persuasive) notion of diversifying for the sake of reducing your portfolio risk. We identify what we want to reduce your concentration to (i.e., how much we want to diversify).

- Calculate the number of shares we need to sell (or donate) in order to fund those life goals. In practice, we also identify specific tax lots to sell, donate, or hold in order to end up with the most after-tax income.

- Lay out a specific schedule (day and time) of when we’re going to sell how many shares. We specify a day of the month (or quarter, if you’re subject to quarterly trading windows) and time of day so that you can implement this schedule without any need for thought in the moment. No thinking required—or desired!—when you’re placing the sales. We’ve already done the thinking (when we craft this strategy), and thinking has a wicked habit of screwing things up in the heat of the moment.

- Determine how many shares we’ll sell at what price. We use both limit sales (to take advantage of any spikes in the stock price when we’re “not looking”) and manual sales (to ensure some sales are happening, regardless of price). We sell more shares when the price is higher, and fewer shares when the price is lower. But we’re always selling some shares.

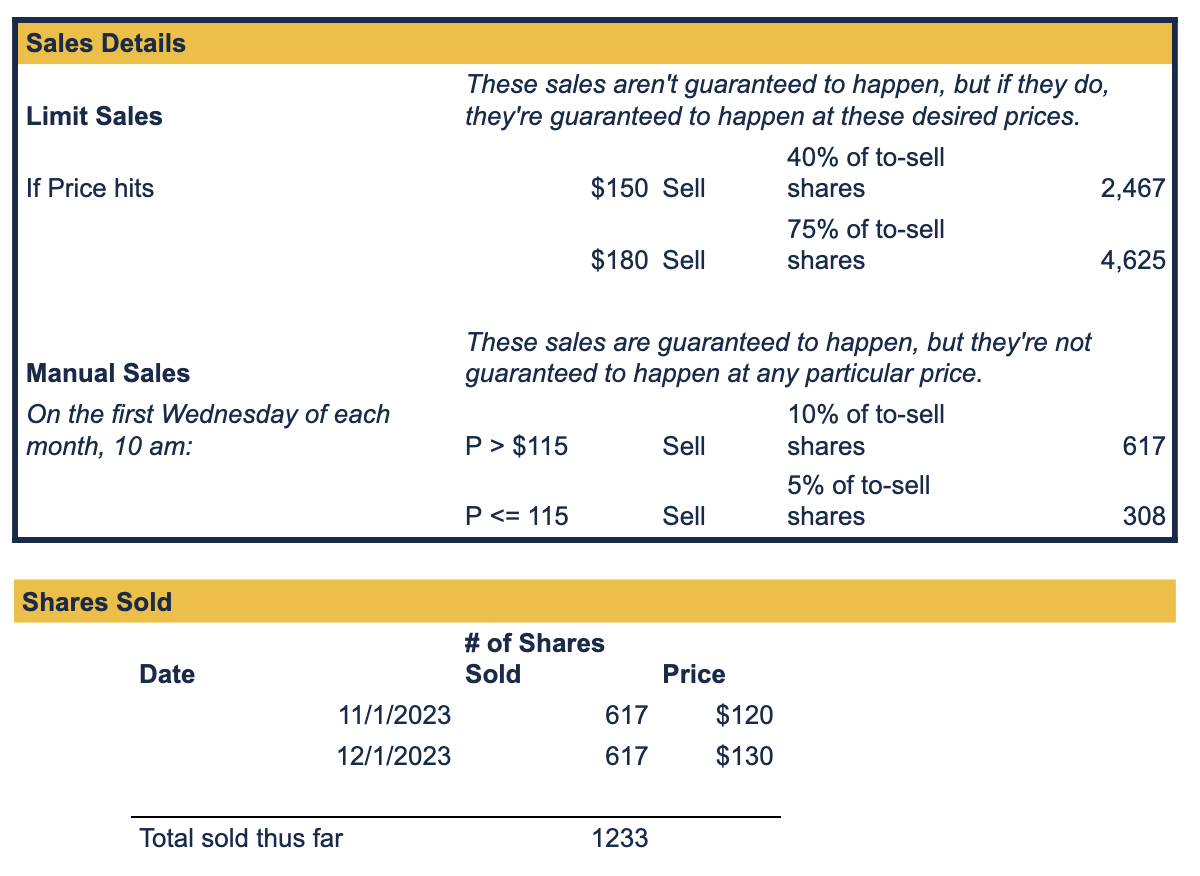

- Keep track of actual sales made, so we can see how close we are to the target.

I am not particularly attached to this particular form of strategy. It’s simply the way we’ve chosen to implement our core principles (which I am attached to):

- center your life’s goals and values

- reduce concentration risk

- manage investor (i.e., your) emotions

If you’ve got a different way of doing all this, great! I just hope you can still attend to those core principles.

If you want to start doing something, something that will feel “right” and intentional, with your giant pile of company stock, reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.