I want to paint walls something other than Sherwin Williams Pure White SW 7005. I want to plant a garden and not have to leave it after just a few years. I want a better kitchen! I want to buy a home!

The lure of home ownership is strong in you, young padawan…and in almost every person I work with. And I get it! I finally bought my first home at the tender age of 39, and while there are definitely downsides, I’m so happy we did it.

There are a million articles out there about renting versus owning, the “true” costs of home ownership, how much cash you should have to purchase a home, etc. And you probably understand intellectually the cost considerations of each path.

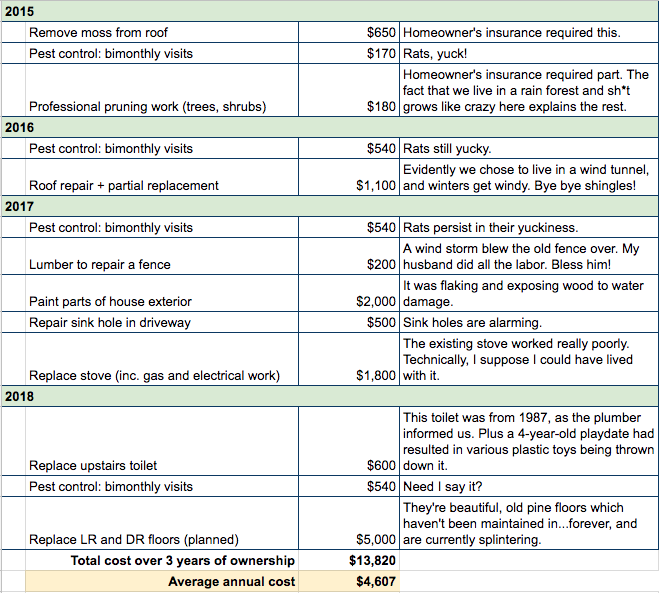

I thought I’d give you a window into my own home ownership and all the costs that have come with it. I find that most people don’t think about these Very Unsexy costs of owning a home, but they can add up fast. And you’ll need to think about them ahead of time when making the “rent vs. buy decision” and make sure to set aside money for them every year you own your home.

I’m guessing you will not have thought of some of the costs that I’ve incurred…and they can be pretty spendy. But when you own the home, you’ve got no choice!

I’m not going to talk about upgrades or improvements. The new wall colors. The new back door so the back stairway landing isn’t in permanent midnight. The replacement of industrial grade carpet to faux-wood flooring. I’m talking about straight up “Please lord don’t let this turn into a pile of rat-infested invasive species dragging our house down around our ankles.”

Let’s call this the Keep Our House Standing and Definitely Devoid of Rats fund. It ain’t small.

My House-Maintenance Costs

I knew that I was going to have to spend additional money every year on top of my mortgage, even on top of the homeowner’s insurance and property tax, to own a home. But I have been taken by surprise by some of the stupid, ungratifying sh*t we’ve had to pay for.

I’m ignoring the costs that we incurred in the first few months of home ownership, as I think we can easily wrap those up in the purchase cost. For example, we spent about $15k on a lot of insulation work shortly after buying the home, but we knew that going in. I want to focus just on the requirements of ongoing maintenance.

For context, we purchased our house for $385k in the summer of 2014. So, on an annual basis, we are spending an average of $4607 (or 1.2% of the purchase price) to maintain our home. The rule of thumb is to budget 1% of the value of your home for annual maintenance, and it looks like we come very close to that number. I suppose that makes me feel better?

Your costs will be different, of course. And I hope very much that they involve fewer “pest control” costs. But you will have your own, unique, unexpected costs just to keep your house from falling down around your ankles. Also, it’s possible that your current rental provides some utilities for free, like water and sewer, or garbage pickup, or heat, or lawn maintenance. These are all additional costs that will now be yours.

I hope you can embrace the romance of owning your own home, and also be realistic about the whole cost of owning a home.

Are you itching to buy your own home? Do you want to work with a planner who can understand and share your enthusiasm, and also bring a reality check to the conversation? Reach out to me at or schedule a free consultation.

Sign up for Flow’s Monthly Newsletter to stay on top of my blog posts and videos, and also receive our guide How to Start a New Job (and Impress Yourself and Everyone Else) for free!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.