Presumably you have been consuming a lot of media about the coronavirus and the recent stock-market drop. Over the last two weeks, the financial media has been bleeding and leading, so I thought a less hysterical commentary on at least the stock-market part might be helpful.

(I know nothing about the coronavirus medically, epidemiologically, nor financiologically, and so, as many of us wish other people would, I will refrain from pretending I do.)

If you are all “Coronavirus? Stock market? What are you talking about?” I encourage you to crawl back under that exquisitely comfortable-sounding rock and stay there for the next little while.

[Note: This blog post is adapted from a note I sent to all my clients earlier in the week. I didn’t intend to put it out for public consumption because Every Damn Finance Commentator on social media (read: Twitter) has already said, more or less, the same thing.

But then I got an “I will not be denied!” response from one of my clients, a mid-career woman with a prominent role at a prominent tech company (how’s that for anonymity?), and she encouraged me to put it out there.

She said “Who is sending the message has a huge impact on who gets the message and how it is received and trusted” and that she’d “talked to several young women in various life situations worried about how the stock market downturn impacts their goals.”

So, with the idea that maybe the Right Information will get into more hands, the more of us put it out there, here goes…]

The Facts

From February 19 to February 27, the US stock market lost 13-14%, depending on whether you’re looking at the S&P 500, Vanguard Total Stock Market Index fund, or some other reasonable proxy for the US stock market. For the record, the Dow Jones Industrial Average is not a useful measure.

During the earlier part of this week, the stock market had recovered a lot of that drop, so that helped quite a bit. Alas, as I write this on Thursday, it dropped again. The stock market is still up this week, but The Hysteria Persists (much like Elizabeth Warren, but less encouragingly).

To the extent you are ruled by your rational brain…

…you are what behavioral economists call an “Econ” (an entirely academic construct that most of academic economics is based on), instead of a “Human.”

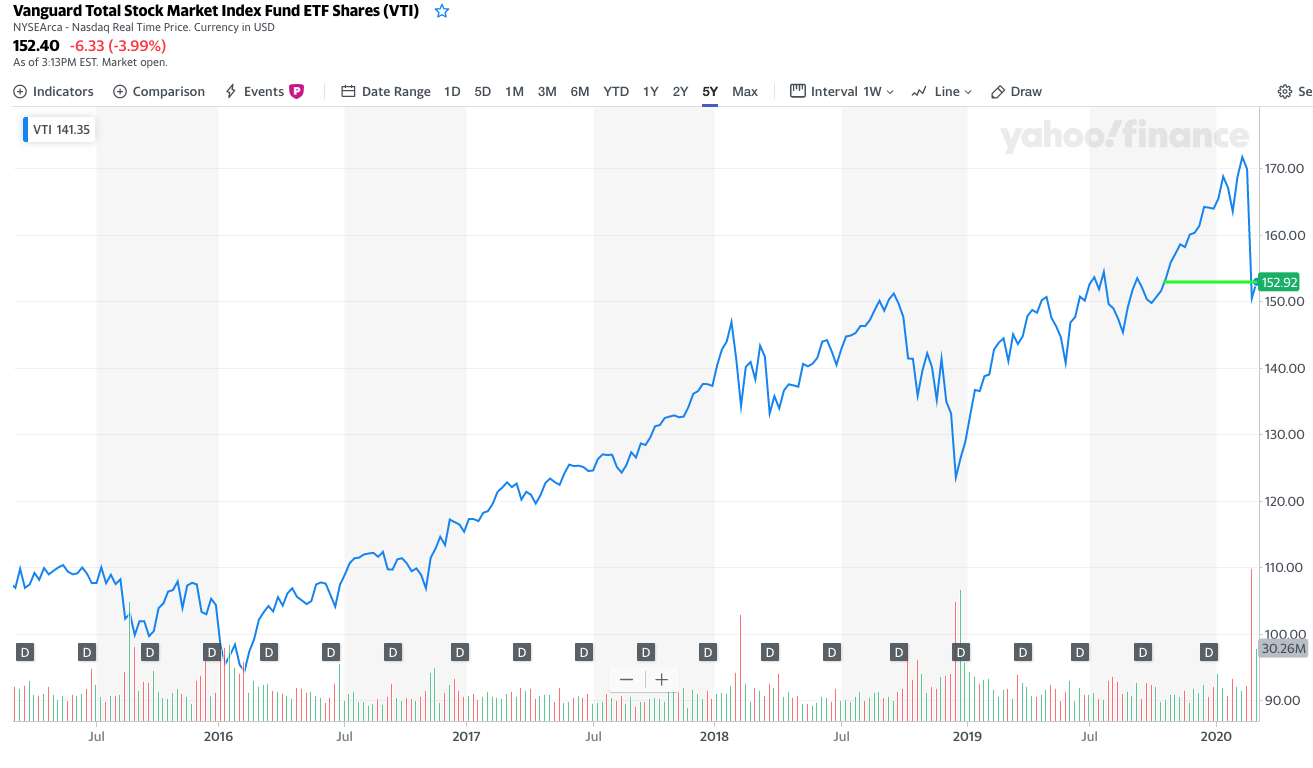

If you have some Econ tendencies in that there lizard brain of yours, then perhaps you will take comfort in this chart of stock-market performance over the last 5 years:

(Some notes: This is the price performance of the Vanguard total Stock Market Index Fund ETF (ticker symbol: VTI), which is a good proxy for “the stock market.” The chart comes from finance.yahoo.com, and their charts don’t include reinvestment of dividends, which would make the return even better over the past 5 years. My point here is to simply show you the trajectory.)

What I cordially invite you to observe is:

- My, the stock market has done Very Well over the last 5 years, even including the recent crap.

- Late 2018 Really Sucked, too…and then the stock market roared back.

- The stock market has fallen to levels that we last saw in October 2019, which is to say, only 4 months ago.

Additionally, this recent scenario is exactly why I discuss with my clients directly (one might even say laboriously) when they need their money. And why I encourage you to have a little sit-down with yourself and do the same. If you need your money:

- in the next 2–3 years, keep it in cash. Go look at your bank account now! It has not lost 14% in the last 2 weeks. (Well, at least, not because of stock market behavior.)

- in the next 3–10 years, invest it conservatively: 20%, 30%, maaaybe 40% in the stock market and other risky assets. The rest should be in safer, less volatile investments. Accounts invested this way have lost much less than 14%.

- 10+ years from now, then you can “safely” ignore it all because you don’t need that money for, let’s review, 10+ years.

And to the extent you are “Human”…

…and reading the media or Twitter, you might be feeling anxious, understandably. Hell, I’m feeling anxious, too. Haven’t quite been able to commit myself to the “no social media” diet, though it’s more appealing each new day.

Please reach out to someone you trust, both to be kind and empathetic, and to not tell you crazy things (“Build a bunker!”). Someone who will welcome you to cry, stress, rage against the machine, etc. Someone who allows you to be afraid, greedy, meandering, or uncertain. Someone who will love you just the same.

If you feel compelled to read more about investing during this anxious time, I highly recommend pretty much anything Jason Zweig has written (for the Wall Street Journal), but in particular this article about “How to Control Your Fears in a Fearsome Market” (written during the 2008-2009 Great Recession).

What we at Flow plan to do going forward, and maybe what you might, too

For now, nothing. As I mention above, we have worked with our clients to intentionally set up their investment portfolios to account for the fact that the stock market can lose a lot of money in a short period of time. We don’t know when, nor how long it’ll take to recover. Hopefully you have done the same, and, if not, my, isn’t this a good time to start? (I say that glibly, but seriously!)

There are, however, opportunities to make lemonade out of this…unpleasantness, if it continues. Investors can do two things:

- Harvest tax losses. Tax-loss harvesting isn’t an unalloyed good, so we don’t encourage doing it reflexively whenever investments lose value.

- Rebalance your portfolio. This will, in effect, buy low (stocks) and sell high (bonds). That’s the holy grail of investing, after all, but it can be hard psychically to buy more stocks after they’ve just lost value. Feels like throwing good money after bad.

I hope you can find comfort, perhaps a lovely rock, in These Here Seems-Like-End-of-Days. Can’t do nuthin’ about the stock market. What you can do is seek out people who provide comfort and empathy and rational, helpful commentary. I hope I have provided a bit of each.

Now, back to hand washing and WFHing!

If you want a financial planner who works hard to provide comfort, empathy, and helpful commentary, reach out to me and schedule a free consultation.

Sign up for Flow’s weekly-ish blog email to stay on top of my blog posts and videos, and also receive my guide How to Start a New Job (and Impress Yourself and Everyone Else).

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.