Over many blog posts and over many conversations with clients and colleagues, I’ve trotted out a few different ways of framing and understanding RSUs. I never know what framing is going to hit home, so I thought I’d gather them all into one post. Maybe one thing I write below will finally make you go, “Oooooohhhhh! That’s how they work.” A gal can hope.

[Note that I’m talking about RSUs in public companies. RSUs in private companies work mostly the same, but they have some important differences.]

How RSUs Work

An RSU is like a cash bonus that you immediately use to buy company stock. Same tax treatment. Same investment situation.

An RSU is like a stock option with a $0 strike price. Which leads directly into:

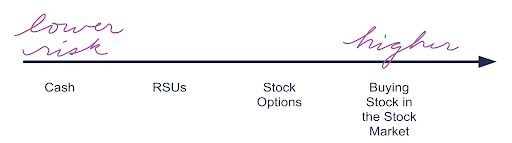

An RSU always has value, unlike a stock option (unless your company goes bankrupt).

RSUs can be almost as low-risk as cash if you sell it ASAP. The longer you hold your RSU share after it vests, the riskier it is, as it can fall in value. Trading windows can get in the way of selling it ASAP, despite your intentions.

The general rule, for companies in the tech industry, is that 1 RSU is worth 3–4 stock options. (If you’re given the choice between options and RSUs, keep that ratio in mind.)

Taxes

Vesting RSUs are taxed the same way as a cash bonus of the same dollar amount.

Most companies automatically withhold all the appropriate taxes when your RSU vests. Except that, for federal income tax, they will typically withhold only the statutory 22%. If your tax level is above 22%, and it probably is, you owe more tax. Some companies allow you to set withholding higher; that’s nice.

There is no tax benefit to holding RSUs. You should hold onto your vested RSUs only if you think the company stock is going to grow in value and would make a good investment choice.

Sell versus Hold?

How much company stock do you already own? How big a part of your financial net worth is it? How much more is coming down the pipe with future RSUs (or ESPP shares or exercised options)? If you have more coming, you can more easily “afford” to sell the RSUs vesting now, because you still have a chance in the future to benefit from any increase in the stock price.

How badly do you need this money? Will you have to meaningfully change your life or plans if the stock loses value?

There is no tax benefit to holding RSUs. You should hold onto your RSUs only if you think the company stock is going to grow in value and would make a good investment choice. Yes, I wrote this one twice. This is a really common mistake and I want you to remember it.

[Note: My default or starting position as a fundamentally conservative financial planner is: Sell it all ASAP. Concentration in company stock is risky. Of course, try telling that to anyone who has hung on to their vested Amazon RSUs over the last decade.]

Fitting RSU Money Into Your Saving and Spending

It’s comparatively easy to figure out how to save and spend your regular, salary paycheck. It’s the same amount every 2 weeks or month. But then every quarter or 6 months, you get this giant lump o’ cash (assuming you sell the vested RSUs). How do you handle that?

You can get as intricate as you want, but I think a very fine starting (and ending) point is this approach:

- Set aside enough cash for federal income tax payments above that 22%. Work with a CPA if this makes your head hurt.

- Try not to depend on this RSU income. If you want to spend it on one-time expenses (travel, clothes, birthday celebration, car, home down-payment), cool.

- Choose a simple, probably arbitrary, percentage that you are going to save out of each RSU vest. Say, save 80% of it and spend 20%. Just save most of it. Every time. Future You will love Now You.

- [Added 5/21/2022] You cannot, unfortunately, automate this savings, as you do your 401(k). Automated savings are best, because you have to make the decision—and effort—to save only once. But because you can’t know the dollar value of your RSU vest ahead of time, you will have to manually save each time this happens. At the very least, get into a habit of moving the cash into the savings or investing account at the same cadence that your RSUs vest and you sell.

I hope something in this collection of RSU tidbits helped you out.

If you want to work with a planner who will help you understand how your RSUs work for you, reach out to me at or schedule a free consultation.

Sign up for Flow’s weekly-ish blog email to stay on top of my blog posts and videos, and also receive my guide How to Start a New Job (and Impress Yourself and Everyone Else).

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.