Two major iterations (and several years) later, my charitable plan is finally where I want it to be. That said, even my original plan was good enough as it was! After all, the charities were still getting our money, and that’s the whole point. So, please, if there’s one lesson you take away from my “journey,” let it be: Just Start Somewhere.

Three years ago, I wrote about creating my own charitable giving strategy. Two years later, I gave you an update (“Now with a Donor Advised Fund!”). I’m back, for the last time (for a while at least), to tell you about my final iteration on my family’s charitable plan.

As I wrote this blog post, I realized that I was writing it less to give you specific ideas for your charitable plan (though if you get those, too, yay!), and more to encourage you to just start giving money in some fashion. Before our family’s initial charitable plan, we gave arbitrarily. Which was (much) better than nothing. Even our initial plan, as documented in that first blog post, wasn’t complete, but it was structured and intentional. I figured I could add more “finesse” later, and lo! I have!

You can always and endlessly iterate on your charitable plan, no matter how small or ill-formed (or non-existent) it is. It’s just like that first draft of a college paper. So intimidating! But if you realize that you can always revise, no matter what version you’re on, it might help you get over your fear of that blank page (or non-existent charitable plan).

What I Did in 2023

In 2023, my husband and I, again, gave:

- 10% of our 2022 Adjusted Gross Income

- in the form of shares of a US stock fund. We’d owned these shares since 2011, so they’d grown by a large percentage, which means we avoided lots of taxes on those big gains by donating instead of selling them! (as described in my first blog post about this)

- to our Donor Advised Fund (as described in the second blog post).

Aside from the administrative nightmare (!! seriously, WTF) of transferring investments in a Vanguard brokerage account to a Donor Advised Fund at Fidelity, this strategy served us well again. (I might actually try transferring the shares from our Vanguard brokerage account to our (empty) Fidelity brokerage account next time, whence into the Fidelity DAF just to see if that makes the money movements easier.)

So, what else is there left to do? I can think of only one thing:

“Bunching” Donations to Maximize Tax Deductions Over Several Years

In 2023, we donated enough so that, along with other itemized deductions, it was worthwhile to itemize our deductions in our 2023 taxes instead of taking the standard deduction. The standard deduction for us in 2023 was $27,700 (for a married couple filing jointly, i.e., me and my husband).

With our charitable contributions (let’s say $30,000), our total itemized deductions were higher than that (let’s say $40,000). Which means we saved more in taxes by itemizing our deductions instead of taking the (lower) standard deduction.

There’s still one improvement left to make: bunching donations, i.e., making multiple years’ worth of charitable donations in one year, and making no donations in those other years.

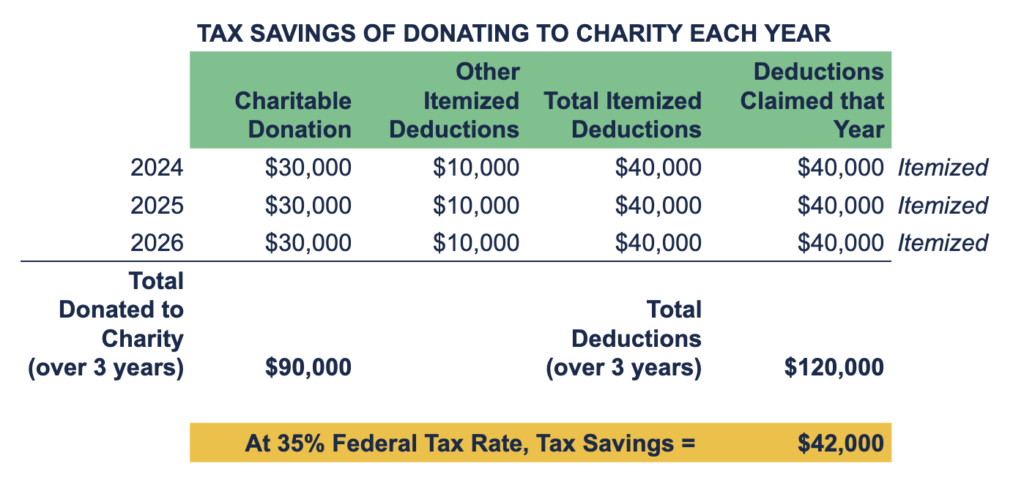

First, let’s see what will happen to our taxes if we continue donating to charity (in our case, our Donor Advised Fund) every year. The standard deduction (for us) in 2024 is $29,200. For simplicity’s sake, let’s assume it and the amount we donate ($30,000) stay the same for three years. That means that every year, we’d end up itemizing our deductions, because the standard deduction is lower.

We’d donate a total of $90,000 to charity over three years and have a total of $120,000 of itemized deductions over those three years. At a 35% federal tax rate, we’d save $42,000 in federal taxes thanks to our deductions.

But you know what we’re doing here? We’re wasting the $29,200 in standard deductions that the federal government just gives to us. Bunching allows us to use those deductions while not losing the greater impact of our itemized deductions.

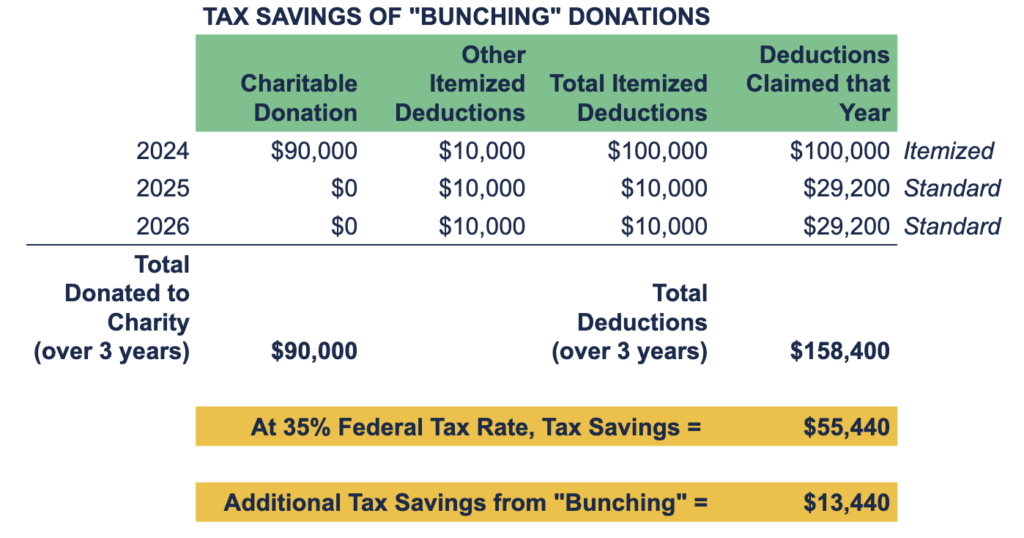

To bunch, we would give $90,000 in one year and nothing in the other two years, for the same total donation of $90,000 over three years. But now see what happens to the total amount of deductions over those three years (it’s bigger), and what happens to the tax savings we get (also bigger):

It’s kinda like magic. You give the exact same amount of money to charity, yet you get more deductions and therefore more tax savings.

Pulling It All Together: My Entire Charitable Giving Plan

Here, then, is my family’s charitable plan going forward:

- In three years (so, in 2026), we add up that 10% of Adjusted Gross Income (from our tax returns) from each of the last three years (2023, 2024, 2025).

- We donate that amount of money (three years’ worth) to our Donor Advised Fund.

- We donate appreciated stock, not cash.

- We identify what causes we care about.

- We identify the organizations we think can best support those causes.

- MOST IMPORTANT STEP We distribute the money from the Donor Advised Fund to the identified charities over the course of the year (or three).

- We don’t donate anything to our DAF for another two years.

- On the third year, start again.

I can see us tweaking the details (donating 5% instead of 10% of our annual income; bunching every two years instead of every three), but the process remains the same.

I hope I’ve inspired you to make just one change, for the better, to your own charitable giving plan.

[ETA 4/12/2024: Inspired by favorite family friend, Taylor, who is in his 80s, I feel the need to add: There are other tax-minimizing charitable giving opportunities that open up once you’re 70 1/2 years old, notably Qualified Charitable Donations. QCDs probably don’t fit well into the “bunching” idea. I write for the younger person, but hey, if you’ve got parents that old, who are charitably inclined, be sure to mention QCDs to them!]

Do you want to work with a financial planner who wants to encourage your charitable spirit, and can help set up straightforward and actionable steps to give? Reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.