I’m ready to embrace my shame.

A new client good-naturedly said this to me as we were embarking on our first meeting, when we go through a low-key mindmapping process to create a picture of the client’s total financial life. And it’s far from the first time a client, prospective client, or acquaintance has made such a comment.

In fact, I recently befriended a woman who half-jokingly told me that “people like her” hated talking with financial planners because she assumed the financial planner would “judge” her for her supposedly foolish money behaviors.

I like to think I’m good at not judging (awareness of one’s own failings goes a long way in not judging others). Regardless of what I try to and hope I do convey to other people, my profession certainly has a reputation of being populated by Judgy McJudgersons who make you feel ashamed of how you’re handling your money.

Why Shame Is No Surprise

While it does sadden me that so many people feel ashamed, it doesn’t surprise me.

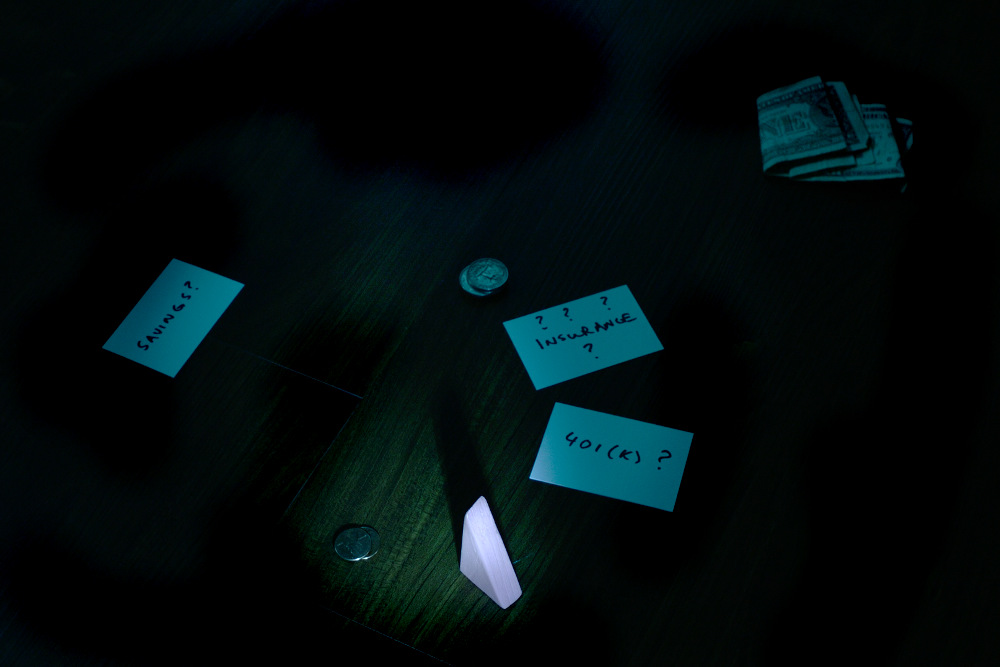

The number of important financial decisions we have to make in our own lives is only growing. A good example: Many people used to have pensions. Their employers put money into the pension system, maybe withheld some of your paycheck automatically and not-optionally, paid investment professionals to manage the pension’s money, and guaranteed you a predictable level of income in retirement.

Now you have a 401(k). You’re lucky if your employer contributes to it. And you have to make all the important decisions—the proper contribution level, how to invest—and you have no guarantees at all in retirement. You can see the same trend in so many parts of our financial lives, which is why financial planning is becoming more and more important for all of us.

Alas, the demands of our day jobs haven’t decreased to make room for these new responsibilities. Many of my clients are smart, driven, and professionally successful…and they wonder “Why can’t I do the same with my money?!” They’re effectively asking themselves why they can’t be a programmer, marketing director, professor, or life coach at the same time they are also an investment advisor, insurance analyst, retirement planner, and attorney. When I put it that way, does it make you feel a bit better about your approach to your finances?

At the same time that we’re dealing with this expanded set of financial responsibilities, social media exposes us all the time to people who claim to do their personal finances right and are totally knocking it out of the park. I think we all know that social media makes us feel inadequate.

And we are also regularly exposed to another group of people who have an interest in making us feel we are not doing it right. There are armies of people running financial firms (of whatever stripe) or monetizing a finance podcast or blog who want you to feel ashamed…so that you’ll work with them.

Why You Shouldn’t Feel Ashamed

Shame doesn’t help. I realize this might be as helpful as saying “Don’t be grumpy!” to your three-year-old whose lip is sticking out so far a bird could land on it (one of the better small-children’s books, by the way). But it’s still true.

Shame can hurt. You might be willing to latch on to Someone! Anyone! who you think might help you get your finances in order. While I think working with a planner to improve your finances is a smart move for many people, there are plenty of “financial professionals” who are quite willing to take your money and provide you with little to negative value.

But most importantly, I suspect many more people are like you (feeling inadequate and stumbling along) than like the Personal Finance Superheroes we see on the intertubes. You are in good company…it’s simply that other people are too ashamed of their finances to share their failings as publicly as those Superheroes do. After all, you’ve probably all heard that people are more willing to talk about sex than money.

How to Feel Not Ashamed

I personally would do just about anything to not feel ashamed or embarrassed.

Learn something.

- Read a book.

Here are some of my favorites. All easy to read, some very short, and some are available free or from your library.- this free PDF from William Bernstein. The guy is a neurosurgeon, an investment advisor, and a finance theorist…yes, he’s crazy impressive. It’s a short read, targeted at “millennials” but applicable up and down the age range, and covers a lot of ground.

- On My Own Two Feet: A Modern Girl’s Guide to Personal Finance. I have not read this, but I have heard many wonderful reviews, plus the author is a fellow Wellesley College alumna so I feel it must be good.

- Personal Finance for Dummies. Yes, really. I read it myself when I first transitioned from tech to financial planning.

- The Little Book of Common Sense Investing By Jack Bogle, founder of Vanguard, creator of the first index fund, all around Dude To Be Reckoned With in the investment world.

- Subscribe to a blog or newsletter.

I think very highly of my own (surprise!), but there are obviously many out there. Choose one, maybe two. (Choose more and you’ll simply overwhelm yourself back into shame and inaction.) You could start with the XY Planning Network Consumer Blog, where you’ll get exposed to writing from many financial planners. Maybe you’ll find one whose writing you like. - Learn where your money is going.

Sign up for mint.com or or ynab (You Need a Budget) and simply look. - Learn about your 401(k).

Find out how much you’re contributing from each paycheck, what you’re invested in, what the other investment options are, and how much the plan costs. If you don’t know how to gather this information, ask your HR person. - Learn more about how your stock options or Restricted Stock Units work.

Get the agreement document from your company (warning: intimidating legalese), then read up on how it works. Two blogs I like on this topic are:

As they say, knowledge is power. I’m hoping, especially for the women out there, knowledge is confidence.

Do something.

- Increase your 401(k) contribution.

- Sell or donate some of your stockpile of company stock.

- Set up a new savings account, and set up automatic paycheck deductions to this account to create a strong emergency fund to cover your hiney when the tech industry eventually implodes or, you know, something less dramatic.

Enlist help.

Yeah, I suppose this is self-serving, as I am an example of said help. And from what I’ve seen with my clients, enlisting a financial professional does bring relief, learning, confidence, clarity, and momentum.

But let me be the not-first to admit that you needn’t start with a professional. Here are some other options:

- Start with a friend or colleague who seems to have their sh*t together. Of course, be prepared that their sh*t is just as scattered as yours is…they’re just presenting a better face.

- Especially if you work for a larger company, your 401(k) plan might come with free (possibly “free”) advice from a representative from the firm that provides the 401(k). Unfortunately, the “Free or ‘Free’”? uncertainty can limit the helpfulness of this consultation. So I suggest you ask the advisor how they’re paid…a flat rate just for giving you advice, or do they get money if you invest in a particular product. If the former, great! If the latter, boo! Also ask if they would be subject to the fiduciary standard when advising you.

- You can try out a robo-advisor, like Betterment or Ellevest, to at least get the non-401(k) part of your investments in check. They’re really easy to get started with, though limited in the help they can give you.

- And then of course, there’s hiring a financial planner. I’ve written a lot about how to find one that’s right for you.

We all know, however, that sometimes other stuff takes priority. Not being in control of your finances today doesn’t condemn you to a life of not being in control of your finances. You’ll get there eventually.

What part of your finances makes you feel ashamed?

Do you want a planner who’s far too aware of her own less-than-perfection to think of judging you for yours? Reach out and schedule a free consultation or send us an email.

Sign up for Flow’s weekly-ish blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer