…don’t permanently increase your expenses.

Take that awesome vacation. Give your Mom the birthday present of a lifetime. Re-furnish your living room. Make an extra big donation to that presidential candidate you love so much. Sock it away in savings so that you can take a sabbatical in a year.

But don’t:

Buy a new home with a high mortgage.

or

Move into a swank apartment with a high rent.

or

Buy a car with a car loan, or whose maintenance is high.

or

Cultivate the habit of eating out all the time. (I think To A One, my clients identify “food” as the expense they’d most like to reduce.)

For my clients who work at public companies (Google, Facebook, Amazon, Tableau, Atlassian, etc.), a biiiig part of their total income each year is in vesting RSUs. Now, I’m not complaining. We marvel at how much money they make just on stock compensation. It’s even sometimes way higher than their salary is…which is still weird to me.

But there are a couple lucky things going on right now for my clients. And maybe for you, too. And by “lucky,” I mean “could change at any time, and we have no control over it.”

- The tech industry has been going gonzo for many a moon now.

- The stock market and in particular their company stock have been going gonzo for many a moon now.

Either of those things, and likely both at the same time will happen at some point. We won’t know when it’s going to happen. We’ll likely only realize it’s happening after the damage is done. That’s the way our stupid lizard brains work…everything is obvious in retrospect and completely unimaginable ex ante.

So, if the tech industry falters, your company stock is fairly likely to drop in value, too. Or your company will stop granting as many RSUs. If the stock market in general falters, ditto. And now all of a sudden, your Sweet Sweet Income is a whole lot less.

Which, yes, will suck. But Will Be Okay if your regular, ongoing expenses can still be covered by your salary. If you’ve been considering your RSU income as icing on the cake, instead of part of the cake itself, then you will still have a cake. With or without icing, cake is still nice.

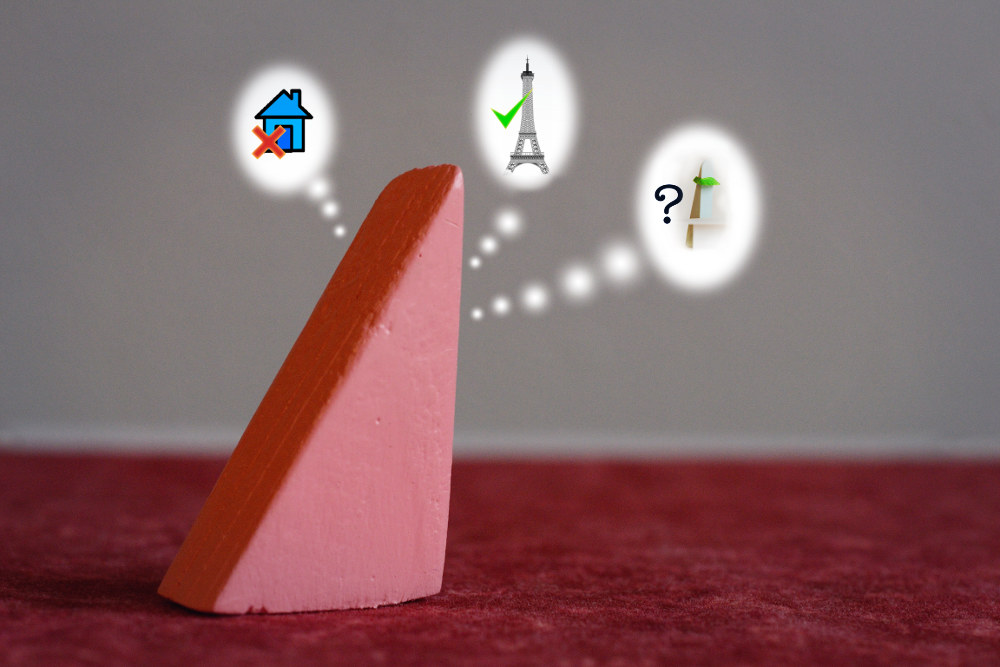

There’s no hardcore numerical analysis involved in this sentiment. It’s really just a mindset:

- Use your salary to cover your “regular” expenses.

- Use your RSUs for something special, something one-time.

Do you want help managing your RSU income, which is awesome, but does slightly complicate your cash flow? Reach out to me at or schedule a free consultation.

Sign up for Flow’s weekly-ish blog email to stay on top of my blog posts and videos, and also receive my guide How to Start a New Job (and Impress Yourself and Everyone Else).

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Meg Bartelt, and all rights are reserved. Read the full Disclaimer.