But, Meg, what will I live on?

A delightful and Highly Suspicious client asked me this recently when I was talking with her about not only maxing out her participation in her company’s (Airbnb’s) ESPP but also maxing out her after-tax contributions to her 401(k).

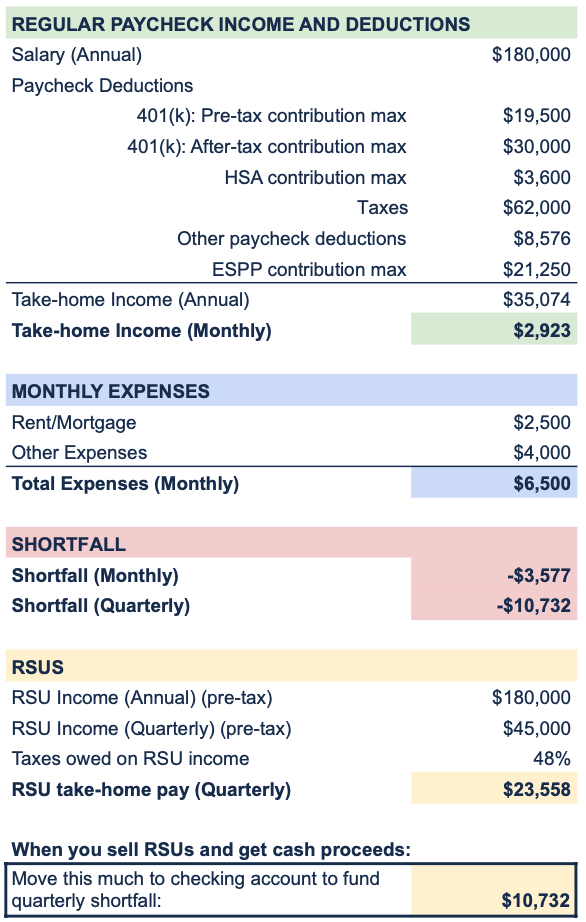

Along with her HSA contributions and pre-tax 401(k) contributions, these contributions were going to make her take-home pay Very Tiny. Too tiny to pay all of her monthly bills.

“Surely, with a $180k salary and gobs of RSU income, I make enough to pay my damn bills. What is wrong here?”

It is rather silly, isn’t it? Alas, it’s unavoidable if you want to take advantage (and you do) of all these awesome programs at work: 401(k)s pre- and after-tax, ESPPs, HSAs, maybe some for-pay employee benefits. All the money for those programs must come out of your paycheck. You can’t pay for them out of your bank account or something.

“How Do I Pay My Bills, Then?”

So, then the question becomes: Okay, if I have to pay for those programs through my paycheck, and therefore my left-over take-home pay is too tiny to live on, what do I live on?

And the answer is usually “your RSU income.”

(If your company happens to not give you RSU income but does offer you an ESPP, then you can do the same with the ESPP proceeds.)

Normally I don’t want people living on their RSU income. At least, I don’t want them relying on RSU income for ongoing expenses. One-time expenses are fine. This is an exception. You’re not truly relying on your RSU income; it’s just a shell game.

Here’s the process we use with our clients in this position:

- Calculate what your monthly shortfall is from your regular paychecks.

- Multiply by 3 to get the quarterly shortfall (because RSUs usually vest quarterly).

- Each time RSUs vest, sell shares.

- Take cash proceeds equal to the shortfall (or a little more, for buffer; in the example below, we move 25% more) and put it into the checking account that you live out of.

That money supplements the too-tiny regular take-home pay for the next quarter.

And here’s an example with numbers taken (more or less) from a real client’s life.

The Complexity of Privilege

I sometimes refer to this process as “laundering” your cash through your paycheck into more favorable accounts (401(k), HSA, ESPP). But perhaps that isn’t the prudent-est way for a financial planner to explain, well, anything.

It really just boils down to the fact that cash is fungible. Doesn’t matter where the dollar comes from, you can still use it to buy groceries. So, if you can’t live on the cash in your normal paycheck because it specifically has to be used elsewhere, then you can live off the cash from your “lumpy” RSU income.

Yes, this complicates things. And yes, this contradicts one of the golden rules of personal finance: Keep It Simple. But this is an irreducible complexity.

I dub it the “complexity of privilege.”

It is truly a privilege to both have the opportunity to have after-tax 401(k)s and ESPPs and have the financial ability to participate in them.

“Why Would I Do This to Myself?”

Life is complicated enough. Why would you choose to make your finances more complicated than they need to be?

Because the benefits of diverting all this money from your regular paycheck into these programs are worth it.

After-tax contributions to a 401(k) (aka, a mega backdoor Roth) are an amazing opportunity for you if you earn a lot of money.

Without this, you’d only be able to get $19,500 into a tax-protected account each year (okay, maybe another $6k into an IRA). With this, you can get $19,500 either pre-tax or Roth and also another maybe $30,000 into a Roth account. That money will grow tax free for the decades it stays in there and will come out tax free decades down the road.

ESPPs allow you to buy your company stock at a discount, sometimes at a Really Big discount, and if you sell the shares ASAP, they can be damn near “free money.”

HSAs can operate as the sweetest retirement account out there: you get tax breaks going in, coming out, and in between. Reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.