Or “Why just putting all your money in the S&P 500 isn’t enough.”

(Okay, probably isn’t enough. I’m not allowed to say much that is definitive about investing.)

Recently I spoke with a woman who asked, “Can you tell me why I want a financial planner to manage our investments? We just put everything in the S&P 500.”

I acknowledged that, yes, an S&P 500 fund can be a great place to put a lot of your money. Good job! I then proceeded to quickly trip and fall down a rabbit hole (it’s really hard to not do this when talking about investing) describing just a single tactic we can use to improve our clients’ investments beyond picking good funds. (It was the concept of asset location, if you’re curious.) She almost immediately responded, “Oh, I didn’t know about that.”

Whiiiiiich prompted me to write this blog post!

Because while I am happy to observe that many people, especially in the tech industry, have drunk deeply of the “low cost, broadly diversified” waters, I have also observed that many of these same people aren’t aware that way more goes into managing investments well. As a result, they simply aren’t aware of the ways in which an investment professional can be valuable.

I believe that most people can benefit from having someone manage their investments. Call me biased. (‘Cause I am.)

In my opinion, there are two reasons to hire someone to manage your investments:

- You don’t want to manage your investments…but you want them to be managed. (Enter stage left: Meg)

- A dedicated professional—someone who has been educated in, trained in, and experienced in managing investments, strategizing about how investments interact with other parts of your financial life, and managing human behavior—can do a better job than you.

Let’s dig in.

Reason #1: You don’t want to do it yourself.

Let’s assume for a minute that you have all the knowledge, time, and self-awareness you need to manage your investments well (assumption to be revisited later).

Maybe, just maybe, you want to do other things with your time, energy, and brain power.

Maybe managing your investments isn’t fun, while other things really are.

Maybe your life is busy enough with job and family and obligations, and piling Yet One More Important Thing on top of that fills you with anxiety.

Maybe you’re in a couple, and you think it’d just, well, work better if someone else did this stuff for you both, instead of one or the other of you either taking on the task for the whole family.

Wouldn’t it be nice to develop a relationship with a financial planner, a person whom you trust to have the skill and integrity to do well by you, and then know that they will take care of it all for you?

Hell, I’m a financial planner myself, and I’m already looking forward to my newly hired financial planner taking over investing our portfolio. Because that’s just one more piece of my brain I can free up for other things, including just sitting there, staring at the wall…but contentedly staring at the wall, not in some sort of anxious, paralytic panic.

So, yes, maybe you can do a perfectly good job managing your own investments. It is entirely reasonable to simply choose not to.

Reason #2: An investment professional can likely do better than you can.

What I don’t mean by this is that I can pick better stocks or mutual funds or ETFs than you can.

In a meaningful way, that part of investing has been commoditized. Whether you use a roboadvisor (ex., Betterment), invest it yourself at Vanguard or Schwab or Fidelity, work with a different financial planner, or work with me, you’ll likely end up with very similar funds. This simply reflects the broad acceptance that no one can beat the market, reliably, over a long period of time. The best bet is to “own the market” at low cost and then Don’t Touch It.

But my, there is So Much More to investing than just “security selection.” That’s the easy part! Thirty years ago, maybe it wasn’t: before ETFs existed, and most funds were actively managed and expensive. But nowadays, you have easy access to inexpensive, broadly diversified funds of all sorts.

I’ve seen a lot of ways in which we help our clients better manage their investments.

Remember the above assumption that “you have all the knowledge and self-awareness you need to manage your investments well”? Now we’re going to test that. I’m going to describe below many of the ways in which I (and many other financial planners) improve our clients’ investments.

Do any of these strike you as, “Oh, didn’t know about that. Wouldn’t have thought of that. Yep, I’ve been suffering from that for a while, and not doing anything to fix it.”? If so, then that is a good reason to hire a professional to manage your investments.

We make sure you’re invested in the right thing.

This is a big topic. It’s probably the most important category of investment work we do for our clients.

You might not know what you’re invested in. We make sure you do.

If you’ve been investing for a while in a 401(k), IRA, and a taxable investment account (or several), all while not really having a strong grasp on investing principles, you can easily default your way into a pretty interesting portfolio. (Yes, “interesting” as the universal euphemism for “f*cked up.”)

The most common “interesting” thing we see in new clients’ portfolios is that they are absolutely dominated by tech stocks, both individual tech company stock and tech-heavy funds.

Clients have never thought about the fact that they own few to no:

- Small and medium size companies US companies

- Companies outside the tech industry

- Companies outside the US

- Bonds

Sometimes, all it takes is pointing this out, and the client is all, “ooohhh…that’s probably not ideal, is it?” (And to be fair, sometimes I point it out, and the reaction is, “….and?”)

You might not know *why* you’re invested in what you’re invested in. We make sure you do.

I want to know why you own the investments you do.

Most of the time, the answer is the equivalent of shrugged shoulders. “…’Cause? I dunno.”

There are a lot of reasonable investment portfolios out there, even for the same person. But that doesn’t mean any portfolio can be reasonable for you. You gotta know why you’re investing in order to know whether a portfolio is right for you.

Once we figure out why you’re investing this money (your kid’s college in 17 years? retirement in 10? to buy a home in two?), then we can make a plan for investing that is targeted at those goals.

Maybe your existing investments are already doing that job. In which case, great, we don’t have to change much, if anything.

Maybe they’re not. In which case, not as great, but fixable!

In practice, this means we make a sell/keep/donate decision for each holding you already own. That way, each investment that remains in your portfolio is a deliberate part of your portfolio, not there because of inertia.

Make sure cash actually gets invested.

Having too much cash that should instead be invested is common.

Usually, you have a ton of cash in your bank account (or in your stock plan account, from selling RSUs) that you simply have no plan for and therefore…just sits there. And sometimes you did in fact move the cash into the investment account…but then don’t invest it.

You know what gives you a better chance of growing your money than letting it sit as cash? Investing it. Crazy, I know.

We regularly scan our clients accounts for extra cash that could be invested…and then pull it into their investment accounts and invest it.

We manage risk.

I’m using “risk” to mean the chance you won’t have enough money for your goals when your goals come due.

So, how do we manage risk? First, we start by identifying your goals and, importantly, how long you have until those goals start and how long they last. You want to buy a home in five years? We’re going to invest that money way differently than for your goal to retire in 20 years and live off of your portfolio for the ensuing 40 years.

We then choose a reasonable balance of:

- stocks (high growth potential but high chance of losing money in any given year)

- bonds (lower growth potential but also lower such chances)

- cash (lowest growth potential but guaranteed to not lose dollar value)

in your portfolio. Say, 70% stocks/30% bonds/0% cash if you’re 10 years from a retirement that could last 40 years.

Okay, that’s the initial risk-management step.

The ongoing management usually involves “rebalancing” your portfolio. As your investments grow or fall in value, that 70%/30% can easily become 80%/20% or 60%/40%. Rebalancing means we’d buy and sell things to get it back to 70%/30%.

Rebalancing conveniently reinforces the investing best practice to “Buy Low, Sell High.”

We try to minimize taxes across your lifetime.

Our goal is not to try to minimize your taxes in any given year. It’s to minimize the taxes you pay over your lifetime. And yes, sometimes that can mean opting in to higher taxes this year to have even lower taxes in the future.

Here are some of the tactics we use to minimize your taxes:

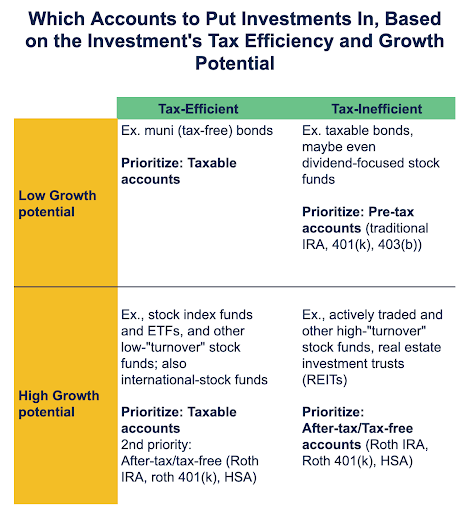

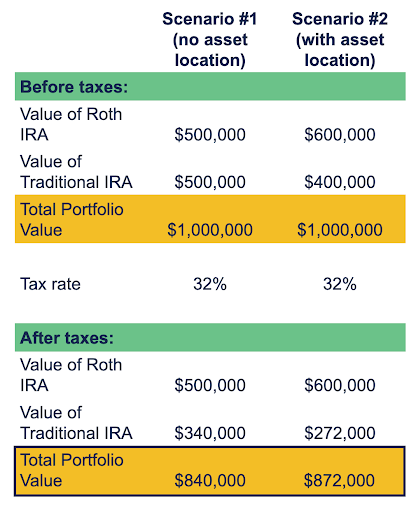

- Asset location: Putting certain investments with certain characteristics in certain types of accounts with complementary tax characteristics. (Learn more about asset allocation and how we implement it.)

- Tax loss harvesting: When the stock market tanks (March 2020, anyone?) this can be an easy way to get a tax break for that year (and possibly for the next several). That said, we might choose to not tax loss harvest if we don’t think it’ll help lower your taxes over your lifetime, even if it helps now.

- Tax gain harvesting: Sell at a gain in low-tax-rate years, and then immediately re-buy the investment. Now, admittedly, usually when people have low-tax years, we focus more on Roth conversions, or doing nothing in order to preserve eligibility for free or reduced-premium health insurance. But it’s a possibility we evaluate each year our clients have low-income/low-tax-rate years.

- Replace tax-inefficient investments with more tax-efficient investments: Usually we find tax inefficiency in certain mutual funds, held in taxable accounts.

- Identify and help you donate “appreciated securities” (investments that have grown) to charity. If you have investments in taxable accounts that have gained in value, it’ll probably save you taxes to donate those investments instead of cash.

We provide pretty pretty reports.

Reports can help you more easily understand what your portfolio looks like and how it’s performing.

We get the administrative work actually done, not perpetually hanging over your head.

The administrative side of managing your finances…well, I don’t need to tell you, it can really suck sometimes. So. Many. Lumbering. Bureaucracies.

It’s our job to help you get through them, sometimes even to get through them on your behalf.

We help you to:

- Open the necessary accounts

- Set up ongoing contributions to your accounts from your paychecks or bank accounts

- Roll your old 401(k) into your IRA. How many old 401(k)s you got out there, just..sittin’ there?

- Roll your IRA into your current 401(k) (to enable a backdoor Roth IRA contribution)

- Convert your IRA to a Roth IRA (aka, a Roth conversion)

- Make your annual IRA contribution. In the correct amount. To the correct IRA. And only when you’re eligible to do so. Including the ever-popular backdoor Roth IRA contribution.

- Change investment selections in your accounts that we don’t manage for you but that we advise on, notably, 401(k)s and HSA.

- Change beneficiaries on all your accounts, when necessary.

- Move your taxable investment account into your trust (i.e., “fund” your trust).

We help you behave in a productive way vis-a-vis your investments.

Pretty much all industry surveys say that clients don’t hire financial planners for behavioral or emotional coaching.

At the same time, we financial planners are all “It’s a super valuable thing we do for our clients!”

So, I mention it here…hesitantly.

In a nutshell, when an investment (stock, fund, etc.) is going up up up, all of us humans naturally think that it’ll simply continue to go up up up. So, hodl! And maybe even buy more?

The role of the financial planner is to say yes, it certainly is tempting, isn’t it? Whoo! That stock, it’s on a tear! Now, let’s revisit your Investment Policy Statement, which tells us why we’re investing and how we’re investing to achieve that goal. Are these changes you’re proposing consistent with that plan? If not, tell me more about why would you want to vary from that plan? If yes, sure, let’s discuss further.

And we’ll do the same thing the next time your portfolio drops a bunch in value, or your company stock, which you own tons of, goes down in value.

It’s not that we planners are special human beings devoid of emotion. It’s that we (ideally) have been trained to have processes that take us out of our emotional brains and into our rational ones when managing investments.

We do all of this, over and over.

There is great value in doing all of this work once, to set up a good investment portfolio.

There is at least as much value in revisiting this regularly, to ensure than the plan is still the right one, and the investments are still serving the plan.

Financial planners (should) have a process for this. At Flow, we incorporate an investment review in each Annual Renewal Meeting. Nothing should ever get too far off track without us noticing it.

So, girls and boys, that is why you might want to have a professional manage your investments.

Do you want someone to do all this for you…and your investments? Reach out and schedule a free consultation or send us an email.

Sign up for Flow’s twice-monthly blog email to stay on top of our blog posts and videos.

Disclaimer: This article is provided for educational, general information, and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. We encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Flow Financial Planning, LLC, and all rights are reserved. Read the full Disclaimer.